Has the AI Apocalypse Arrived? Tens of Thousands Being Laid Off in Big Tech – AI has to Either Replace Them or AI Spending Must Stop

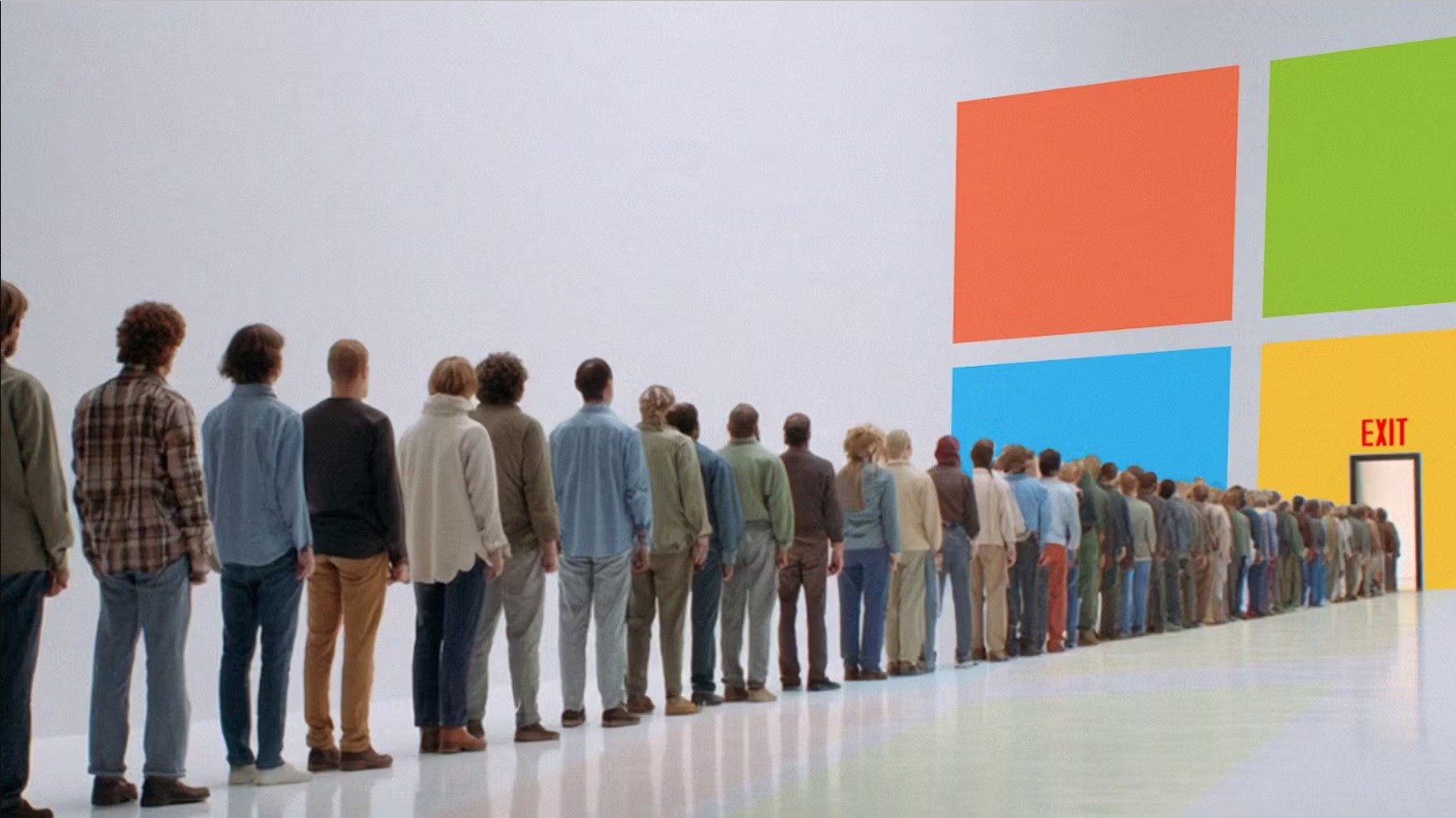

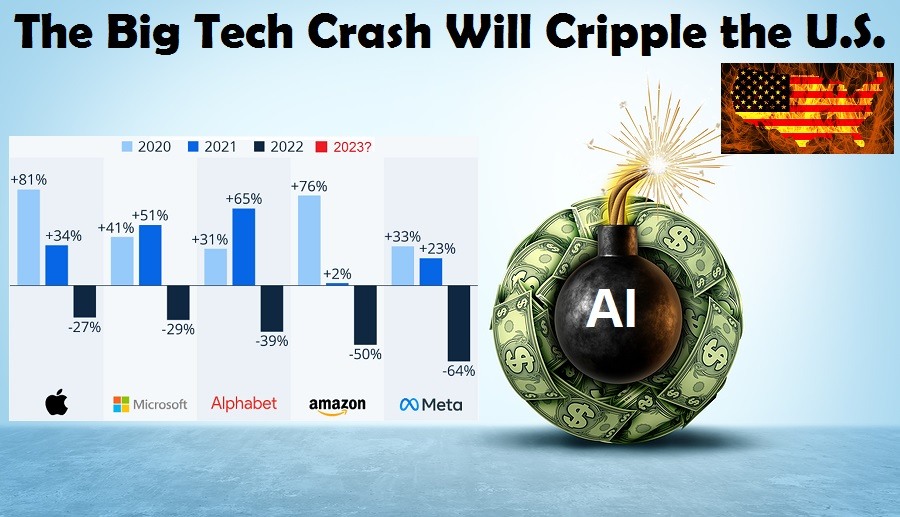

Tens of thousands of employees are being laid off in Big Tech, again, and the narrative that is being spun in the U.S. press, both corporate and "alternative", is that AI is replacing their jobs. But if you dig into the news about these layoffs, you will quickly see that it is NOT AI that is replacing their jobs, it is AI SPENDING that is forcing them out of their jobs, as this spending on anything and everything related to AI has continued to increase and inflate perhaps the largest financial bubble in world history. In other words, if you don't already work in helping to build the AI bubble, your technology job is in danger. Earlier this week Microsoft laid off 9,000 employees, just shortly after they had laid off 6,000 employees a few weeks earlier, with a total of 15,000 employees laid off so far this year. When they did their most recent round of layoffs, Microsoft told their existing employees to "Invest in your own AI skilling." In other words, either learn how to make AI useful and productive, or risk losing your job, because Microsoft and everyone else is still investing in AI, big time, whether it is profitable or not. So the Big Tech massive layoffs that began in 2022, are now picking up speed again after a brief slow down to jump aboard the new AI bandwagon. But things are MUCH WORSE here in 2025, than they were in 2022, because now it is not only the private Big Tech firms who are laying off people in the technology sector, so is the U.S. Government. NASA just announced this week that they are laying off over 2000 SENIOR STAFF.