Alternative Health looks at alternative ways of treating illness apart from the medical system.

A New World Order is Emerging as the Davos Banking System Collapses

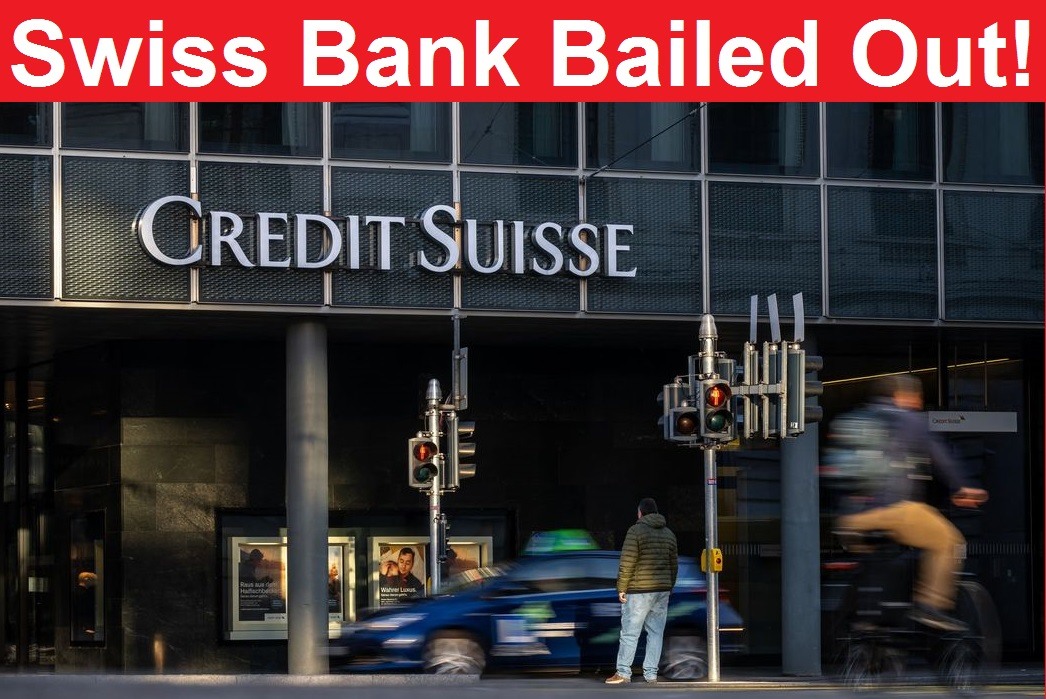

With the collapse yesterday of the world's first SIFI (systemically important financial institution - "too big to fail") bank, Credit Suisse, the reality that the financial system of western culture is now on the brink of collapse is starting to sink in with Americans. While still not headline news in the American corporate media, financial headlines were notably pessimistic today, even with the stock market posting gains. The more dire outlooks are still being published as "opinion pieces," but it appears that more and more Americans are starting to face the reality that life as we have known it, is about to radically change. Here is an article that was featured on the Home Page of Market Watch for most of the day today, while the markets were open. And while it is listed as an "opinion" piece, it sure reads like a news article to me. "Opinion: The end of the ‘everything bubble’ has finally hit the banking system. Credit Suisse and SVB might be just the first of many shocks." The independent financial alternative media, without needing investors and editors' approval to print anything, was much more apocalyptic. Here are a few headlines from ZeroHedge News today: "The Banking System is On The Brink of Collapse," "This Financial Crisis Will Be Like None Other In History," "Nowhere To Hide In CMBS: CRE Nuke Goes Off With Small Banks Accounting For 70% Of Commercial Real Estate Loans." A New World Order is emerging, and it is NOT led by the Davos Crowd and the World Economic Forum.

Swiss Bank Fails! Bail-ins Implemented as Seniors’ Pensions Raided – Chaos in Europe as France Burns

Credit Suisse, which was the second largest bank in Switzerland, and considered a "too big to fail" bank, has failed. Swiss authorities rushed through a deal late Sunday in an attempt to prevent a whole-scale stock market crash before trading started in Asia, along with futures trading in the U.S. The deal involved a forced fire sale to its rival bank, the largest bank in Switzerland, Swiss National Bank (SNB), which included both bailout money from Switzerland's Central Bank for SNB, along with a bail-in of AT1 bonds with Credit Suisse used to fund seniors' pensions, which will be completely wiped out. The bail-in wipeout of senior pensions is sure to fuel protests already happening around Europe over pension reforms, especially in France where protests began Thursday night last week when President Emmanuel Macron invoked what is basically an "executive order" before the French Parliament was about to vote on, and DISAPPROVE, pension reforms. The French have been rioting in the streets since then, continuing through Sunday night, as at the time I am writing this there are still livestream reports being broadcast showing much of France burning. Could we see similar types of bail-ins and pension funds disappear in the U.S.? Here is what the CEO of the largest investment firm in the U.S. said a few days ago...

Bailout Failure! Bank Runs Drain $550 Billion In Deposits In One Week – Are we Looking at an Infrastructure Collapse that will be Blamed on “Cyber Attacks”?

After a brief reprieve of declining bank evaluations yesterday (Thursday March 16, 2023) due to some of America’s largest banks stepping forward to provide an infusion of $30 billion for San Francisco's troubled First Republic Bank, considered the next FDIC bank about to collapse, the financial system took another hit today in the Stock Market as it lost confidence in the ability of the larger banks to step forward and bail out smaller banks. If anything, it appears more likely that the criminal banking cartel is about to consolidate their power by driving the smaller banks out of business. And in the midst of bank runs and declining bank valuations this week, the Corporate Media published reports about possible cyber attacks being launched by Russia, according to a "research report" published by Microsoft. Big Tech, which we previously reported is now controlling the country's infrastructure in Ukraine, is also mostly running the operations for the U.S. military today. So when you discuss private companies who receive $billions from the U.S. Government in defense contracts today, you need to add Microsoft, Amazon.com, Google, and Elon Musk's Starlink, and other tech companies to the list of traditional private defense contractors such as Lockheed Martin, Raytheon, Northrop, etc. If the U.S. Government cannot stop the bank runs and the collapse of the banking system, will they just turn to Big Tech to shut down the entire system, either by taking down the Internet or the electrical power grids, or both, and then blame it on Russia and use it as an excuse to start the World Economic Forum's "Great Reset" agenda?

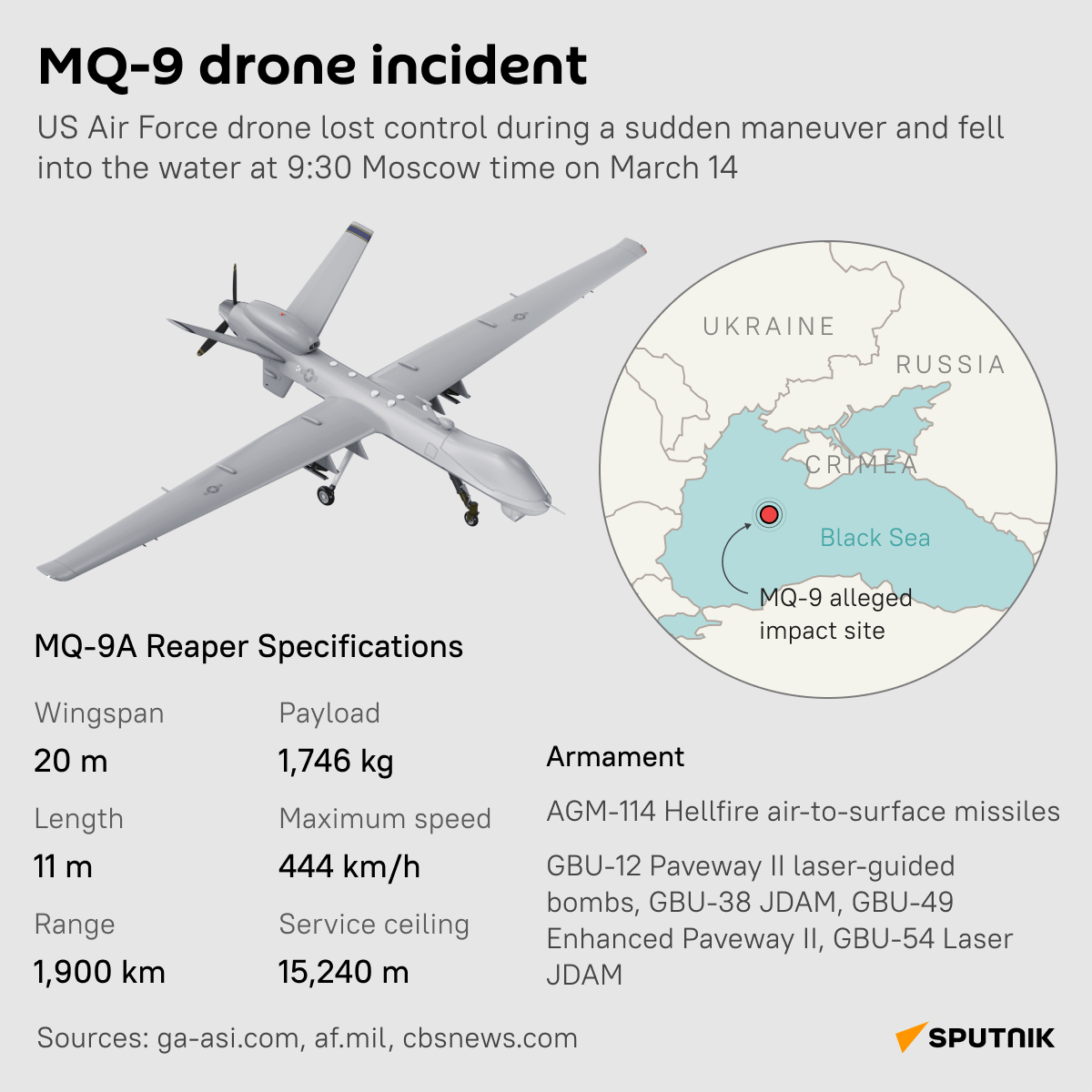

U.S. GOP Senator Calls for Shooting Down Russian Planes as War with Russia Escalates

As the world stands on the brink of a total financial meltdown, the U.S. corporate media was controlling the narrative in a different direction today focusing on the downing of a U.S. drone over the Black Sea that they claim was shot down by Russians. U.S. Senator Lindsey Graham appeared on Fox News to state that the U.S. should now start shooting down Russian planes, because "that's what Ronald Reagan would do," and of course, this is all "Biden's fault."

Banking Crisis Worsens: Swiss Bank is First “Too Big to Fail” Bank to be Bailed Out as Saudis Withdraw Support

Switzerland's second largest bank, Credit Suisse, which has been experiencing bank runs and plummeting stock valuations since the end of 2022, became the first SIFI (systemically important financial institution), or "too big to fail" bank, to crash today forcing regulators to step in and ensure a bailout. The Saudis almost single-handedly crashed the U.S. Stock Market (and stock markets around the world) this morning when they announced that they were not going to put any more money into the failed Swiss bank. While the U.S. Stock Market did end lower today, it most assuredly would have been a blood bath if Swiss Regulators had not stepped in to ensure the world that it was going to bail out their troubled bank. This was after European markets had closed, however, and European banks' stock values lost 7% at end of trading in Europe today. Since a simple statement made by Saudi National Bank Chairman Ammar Al Khudairy almost crashed the entire world's financial system today, what does that tell you about the frailty of the current banking system?

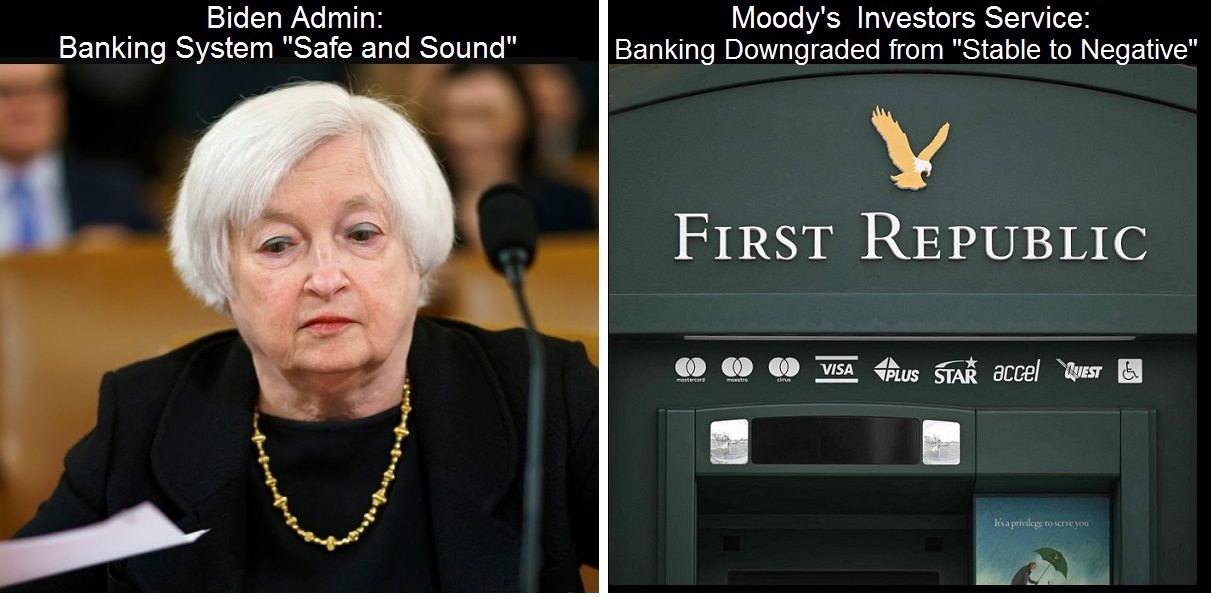

Moody’s Downgrades Banking System from “Stable” to “Negative” – Crypto Takedown in Place with “Operation Choke Point”?

In spite of the fact that President Biden and U.S. Treasury Secretary Janet Yellen have told Americans that the U.S. Banking System is "safe and sound," Moody's Investors Service today announced that they had downgraded the U.S. banking system to "negative" from "stable" to reflect “the rapid deterioration in the operating environment.” They also announced today that they were studying First Republic’s debt rating for a potential downgrade, along with five other regional banks. Sifting through the plethora of news today regarding the banking industry's woes, there are some who are now questioning why the Feds closed down Signature Bank on Sunday, when other banks appeared to be worse off. This has led to speculation that cryptocurrency banks are being targeted, and the revival of the "Operation Choke Point" conspiracy theory.

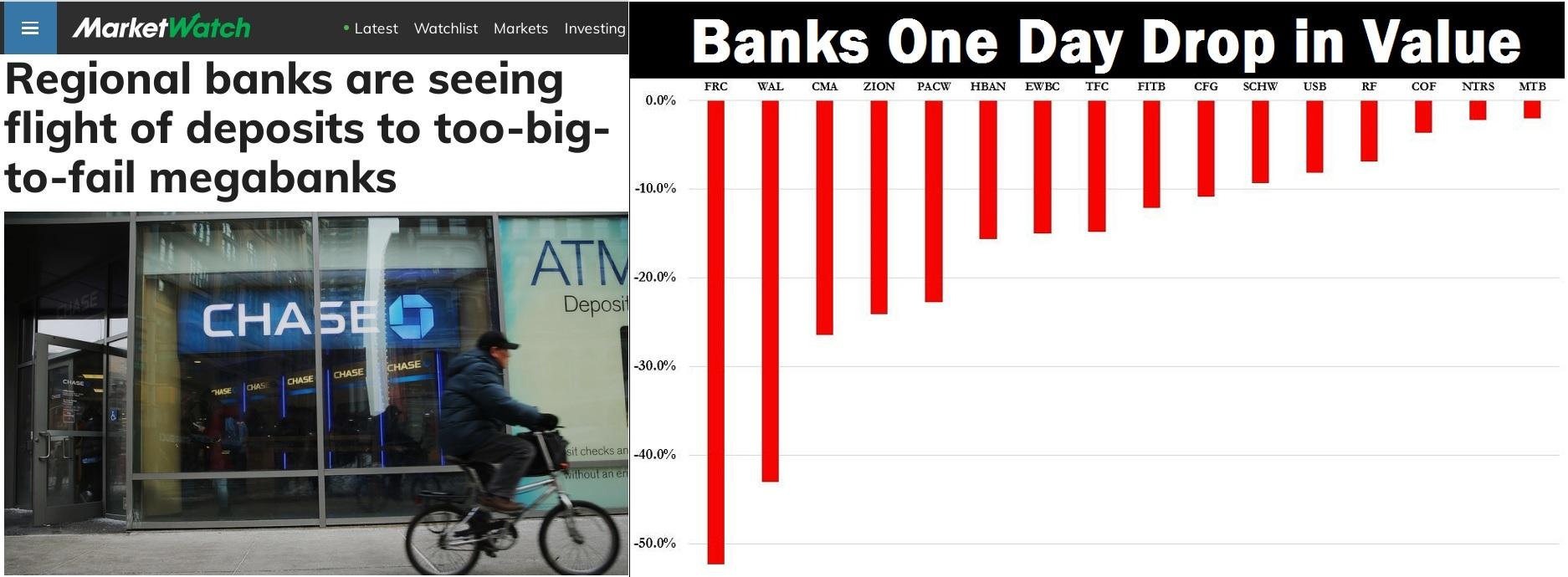

Bank Runs Continue as Multiple Banks on Verge of Collapse

While the Fed's move yesterday (Sunday, March 12th) to bailout depositors from the Big Tech banks that crashed in recent days may have prevented a stock market crash today, it did not stop the bank runs, and more than 30 banks halted trading at one point today. Most banking is done online now, so long lines at banks to withdraw funds are not something most are going to see these days. What is happening instead is that customers are withdrawing their funds from the riskier, mostly smaller banks, and putting them into larger banks that they believe are "too big to fail" because they believe the Fed will step in to prevent that. While this is quickly turning into a partisan issue with each side blaming the other, open up your wallet and look at the color of your federal reserve notes (known as U.S. dollars). They are GREEN, not blue, and not red. You "reap what you sow" is a fact of life, not only in agriculture (you can't plant corn and expect to harvest watermelons), but also in the financial world, and after years of corruption in the business world and financial markets, the time to reap the consequences seems to be upon us. America has prospered for too long off the backs of cheap labor outside the U.S. while investments and start up firms have become just as risky and worthless as gambling in Las Vegas, throwing money around as entertainment without producing anything of real value. This is a MORAL issue, not a political issue. The time to pay off our debts that we have immorally been ignoring for decades, no matter which political office has been in power, is now upon us it would seem.

3rd FDIC-Insured Bank Fails in 5 Days but Feds Avoid Black Monday by Bailing Out Depositors

Sunday morning U.S. Treasury Secretary Janet Yellen appeared on Sunday talk shows to announce that the Fed was NOT bailing out Silicon Valley Bank or any other banks, as they did in 2008. However, faced with the possibility of bank runs and a Black Monday collapse of the stock market, the Feds apparently reversed course (or maybe this was their intention all along?) and did just exactly what they said they would not do, and put into place a program to bail out depositors who were not covered by the FDIC's limit of $250k per account. The FDIC also closed another bank, Signature Bank in New York, but assured depositors that they could get all of their money out of their accounts on Monday. And it worked, as futures trading that began Sunday night jumped up, instead of crashing, and Wall Street breathed a deep sigh of relief. We now have had 3 FDIC-insured banks fail in 5 days, but it doesn't matter if your account was insured or not, as the Fed is just going to give everyone their money back. So the financial Armageddon has been postponed, again. The Big Tech billionaires, like Mark Cuban, whined and complained over the weekend that the Fed was not stepping in to save them, so the Fed obliged. The banking system was saved, for now, so the $billions can continue to pour into Wall Street to fund the military industrial complex to continue their wars, as well as $billions flowing into Big Pharma to keep funding never-ending emergency use authorizations for new drugs and vaccines. This won't fix the systemic problem with our financial system, but at least depositors should be able to get access to their money Monday, even though that money will be worth far less than it was on Friday. Get ready for the mass consolidation of the banking industry now and the rollouts of Digital IDs and eventually Central Bank Digital Currencies (CBDCs).

The Government May Stop Issuing Social Security Payments After the Debt Limit is Hit

There’s a very real possibility the government will stop issuing Social Security payments after the debt limit is hit. Scary as that prospect is, however, the alternative might be even worse: A little-known provision of a 1996 law could be interpreted to allow the Social Security trust fund to be used not only to pay Social Security’s monthly checks but also to circumvent the debt limit and pay all the government’s otherwise overdue bills. If that happens, any short-term relief to Social Security recipients would come with a potentially huge long-term price tag: The Social Security trust fund could be exhausted much sooner than currently projected—in just a couple of years, in fact.

2nd FDIC-Insured Bank in 3 Days COLLAPSES! Bank Runs, Trading Halted on Some Banks

Silicon Valley Bank became the second FDIC-insured bank to collapse in 3 days today. They are reportedly the 16th largest bank in the U.S., and the largest bank to collapse since the 2008 financial meltdown, and the second largest bank to ever collapse in the U.S. While it was still not the main headline news this morning in the corporate media, a glance at the headlines as I began to write this article shows that it is apparently now getting the headline news it should receive, as bank runs are starting, and some banks suspended trading today to stop the carnage. The Alternative Media is mostly still asleep, ranting and raving about new "Jan. 6 footage" and the Tucker Carlson show, or talking about the latest AI technology that is going transform everyone into transhumans and hack our brains. But this news about Silicon Valley Bank collapsing today has led to a dramatic drop in value in trading for ALL banks, and several of them reportedly suspended trading on the NYSE for a while today. Bank runs have also been reported across the country.

Four biggest US Banks Lost $52 BILLION in Valuation Today as Dow drops 540 points

The corporate media is now widely reporting on this, and the entire banking sector took a huge hit today, losing $billions in valuation, $52 billion lost just with the four largest banks in the U.S. Bank runs and bank failures are no longer an "if," but simply "when." Which ones are next?

BREAKING: Silicon Valley Bank Run has Reportedly Started – Website Down

The news is moving fast now, with the report of Silicon Valley Bank (SVB) being in trouble, after Silvergate Bank announced yesterday that they were liquidating their assets and shutting down. A bank run has apparently just started at SVB, with reports that people cannot access their funds, and that their website is down. This is a developing story...

WARNING: Big Tech Banks Collapsing! Infection Spreading to Other Sectors

The collapse of the banking industry has started, with FDIC-insured Big Tech Silvergate Bank announcing yesterday they were liquidating their assets and closing down. Silicon Valley Bank also announced yesterday that they have lost $10 billion, while trying to reassure depositors to just "stay calm," suggesting that their collapse is also probably imminent. I don't think there has been a more significant news event in the financial sector since the financial crisis of 2008, and yet at the time of my publishing this article, none of the corporate media is treating this as a headline story, unless it is a publication that focuses only on financial news. This is the beginning of the storm that should have happened last year after FTX blew up, and probably did, but the infection that I have been calling The Big Tech Crash that started in 2022 has only just now begun to reveal how serious this crisis is, which can no longer be hidden from the public as the bank failures have now begun. Bank runs that began last year, are only going to significantly increase in the days and weeks ahead. And this infection is not confined to Big Tech and their banks, but is spreading fast to other sectors of the economy.

Trump’s Call for Building “Freedom Cities” Plays Right into Globalists’ Plan for Fourth Industrial Revolution Control Grid

Low and behold, the paragon of American conservatism has now come out of the woodwork with a message built on repackaged, reformulated smart cities as the way to go moving forward. Because the globalists’ climate agenda doesn’t resonate with conservatives, the globalists need a prominent conservative political voice who could take their message and communicate it in a way that appeals to conservative patriotic Americans. Enter the perfect stooge: Donald J. Trump. In the same way Trump offered his services to the globalists when he sold their deadly mRNA clot shots to conservatives, he is now signaling to them that he is willing and available to be used again — this time to convince us to move back into the cities, where we will be safe, secure and well taken care of. Instead of warning us about the globalists’ plans for digitization of everything, including our money and our very identities, Trump puts his own patriotic twist on the same globalist technocratic theme. He is distracting us here with stupid talk about flying cars and Americanizing the tools of our slavery. Instead of buying the tools from China, he will make sure they’re all American-made. Doesn’t that make you feel warm and fuzzy inside?

Big Tech Crash Accelerating in 2023 – Billions Lost on AI, Bank Failures, CHAOS!

The Big Tech Crash of 2022-2023 is accelerating here in 2023, and yet almost nobody is sounding the alarm as to just how significant the crash is going to affect everyone's lives. Instead, we are pummeled every day with reports in both the corporate and alternative media about how the technology is advancing, and that AI is poised to take over the world and replace humans. Nothing could be further from the truth. While it is easy to collate the news and come to this very simple conclusion, that Big Tech is crashing, I have yet to see one other journalist refer to what we are now seeing as a "Big Tech Crash" which is very rapidly making the Dot.com technology crash of 2001 look like a walk in the park by comparison. According to Layoffs.fyi, there have now been 125,977 layoffs in Big Tech for the first two months of 2023. There were 161,411 layoffs in Big Tech in all of 2022. As we complete just the 1st week of March, 2023, things are only getting worse, much worse.

JPMorgan Chase CEO Fights Deposition in Lawsuit Charging Chase Bank Being the Cash Conduit for Jeffrey Epstein’s Sex Crimes

In the Attorney General’s office of the U.S. Virgin Islands' lawsuit against JPMorgan Chase, the largest bank in the U.S., which is being accused of knowingly funding Jeffrey Epstein's pedophile sex operation, CEO Jamie Dimon is being deposed to testify under oath in the case, although his lawyers are trying to prevent him from testifying. Investigative journalist Whitney Webb has recently published a 2-volume book covering the work of Jeffrey Epstein, and she identifies the main businessmen who financed Epstein's work: Billionaire Leslie Wexner who owns retail giants like Bath & Body Works and Victoria's Secret, Billionaire Bill Gates, and Billionaire Donald Trump. Jamie Dimon is the CEO of Chase Bank which is allegedly where Epstein held his accounts.

Bank Runs Quietly Continue to Increase Where Depositors Cannot Withdraw Their Funds

While we have not seen a total collapse of the worldwide financial system yet, bank runs that began in 2022 with the collapse of FTX and the $billions that were lost when depositors were not able to withdraw their funds, continue to happen here in 2023, although they do not get headline news coverage. Last week, Pam Martens, writing for Wallstreet on Parade, reported that bank runs were happening at Silvergate Bank, a U.S. FDIC insured bank. Credit Suisse, the second largest bank in Switzerland, which saw bank runs begin last fall, continues to see a mass exodus of depositors as its stock continues to fall here in 2023. It was also reported last week that Blackstone had defaulted on a $562 million bond, and was blocking investors from cashing out their investments at its $71 billion real estate income trust (BREIT). Unfortunately, this is probably just the tip of the iceberg in terms of bank failures and bank runs that await depositors, and I am not the only one saying that, as the U.S. and many European countries are now preparing for bank runs.

Ukraine has Become the Model Worldwide for Digital IDs and the Complete Digital Transformation of Society

Central Bank Digital Currencies (CBDC) have received a lot of attention in recent weeks, in both the alternative and corporate media, as pushback against them mounts. We reported last year that credit union and banking trade groups released a joint letter to the chair and ranking member of the House Financial Services Committee, warning of “devastating consequences” if the Federal Reserve moves forward with a Central Bank Digital Currency (CBDC). Even the Wall Street Journal recently published an opinion piece warning against the implementation of CBDCs. China is further ahead than the U.S. in rolling out their Central Bank Digital Yuan, but they have had such a hard time getting people to use it, that they started giving it away during the recent Lunar New Year celebrations. Replacing a monetary system and convincing businesses and consumers to stop doing business and stop using cash, is not something that is going to be adopted overnight, and as we can see, there is going to be major pushback against this. However, the goal of a digitized society that requires a digital ID to participate in society and allows the government to pretty much track everything you do, can most certainly be accomplished without the full implementation of CBDCs, and in fact it is already happening in one country: Ukraine. Ukraine rolled out their digital ID and digital transformation program in 2014, which then kicked into high gear in 2020 when COVID was unleashed, and is now almost complete thanks to the war, and help from Elon Musk who provided satellites to connect all the Ukriane people to the Internet and the adoption of the Diia app. So while everyone has been worried about CBDCs and their loss of privacy in such an economic system, Ukraine has already developed a digital transformation of society that is now the example worldwide of how a government can track all of its citizens, even without a CBDC. About 9 years in development now, Ukraine is probably the model country on how to make a complete digital transformation of society. It is powered by American Big Tech companies, with Google services now providing the country's infrastructure. Zelenskyy even wants to hold the next elections via the app. What could go wrong?

Source: Forestry Workers Find Animals Dying at Alarming Rates in Ohio Parks Following East Palestine Train Derailment

Although Ohio Governor Mike DeWine, the Environmental Protection Agency, and local officials continue to assure Ohioans that recent air monitoring and water sample tests have shown no concerns with air quality or water quality in East Palestine’s municipal water supply, following the catastrophic train derailment on February 3rd, forestry workers have found that animals are dying at alarming rates. A source told The Ohio Star that her husband, a wildlife biologist and consultant for the federal forestry, received hundreds of calls on both Sunday and Monday from colleagues who say forestry workers have found hundreds of dead animals in Ohio’s parks.

Largest U.S. Grid Supplier Issues Dire Warnings About Nation’s Electricity

The United States appears to be heading into major power grid failures as coal plants are shuttered while electricity consumption continues to climb to produce enough electricity to power electrical vehicles, and the explosion of data centers needed to run AI and increasing computing power.