Alternative Health looks at alternative ways of treating illness apart from the medical system.

Apple Files More Patents on Biometric IDs – Is the iPhone the Most Evil Device on the Planet Now?

The Apple iPhone is currently used by over 120 million people in the U.S., capturing almost 50% of the mobile smart phone market. Worldwide, about 1 billion people use Apple iPhones. If you own an Apple iPhone, do you have any idea how much of your personal life and data are now owned by Apple in exchange for allowing you to purchase and use one of their devices? Apple works hand in hand with the U.S. Government and their intelligence agencies to track as much information about you as possible. In an article published today, June 1, 2023, Reuters reports that the Russia's Federal Security Service (FSB) is claiming that the U.S. NSA has used Apple iPhones for an American espionage operation inside Russia. Apple has been awarded dozens of patents in the past few weeks for biometrics to be used with a national ID, including fingerprints, faces, and irises from your eyes. Back in April we reported how Apple was teaming up with banking giant Goldman Sachs by offering attractive rates on savings accounts through their Apple Wallet. Within four days of Apple's launch of their high yield savings account, almost 1$billion was deposited into the new account by Apple iPhone users. But now, more than a month later, many iPhone users are complaining that while it was very easy to deposit funds INTO the new Apple account, getting those funds OUT OF the account has often proved difficult. So why do you still own an iPhone? Do you not recognize that it is an instrument for evil? Just look at Apple's logo, the apple with a bite taken out of it. What does that represent?

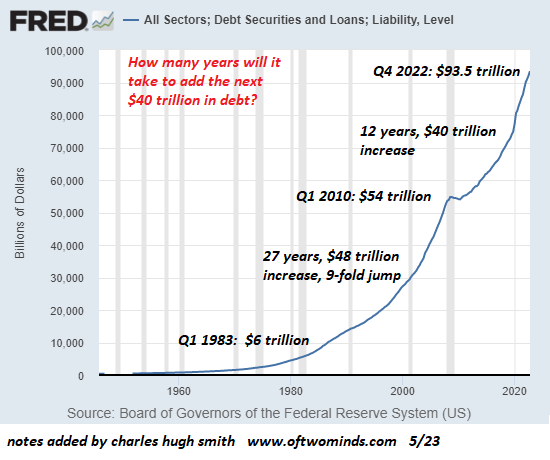

The Western Banking System is on the Brink of Collapse

There is virtually nobody in either the corporate or alternative media these days who are not warning about the serious problems with U.S. and European banks today. Even if a U.S. debt ceiling agreement is reached this week, it will not save the banking system. I am highlighting two new articles published today that reveal just how dire the current banking crisis is, and what may be lying ahead in the not-too-distant future with a new financial system rolled out and the implementation of Central Bank Digital Currencies (CBDCs). First, Pam Martens of Wall Street on Parade reports on a new IMF projection for the U.S. economy. Next, Sam Parker, writing for Behind the News Network, just published a 2-part article titled "They're Coming for Your Money." He reports how the two families that control western banks, the Rockefellers in the U.S., and the Rothschilds in Europe, are planning on bringing down the entire western banking system to implement the "Great Reset" and roll out programmable Central Bank Digital Currencies.

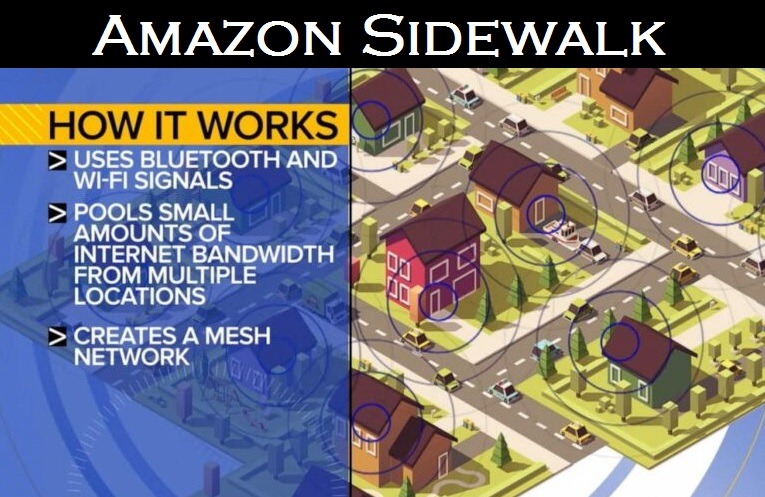

Big Tech Communism has Arrived: Amazon Sidewalk Joins the Helium Network to Connect All Internet of Things (IoT) Devices

Big Tech Communism has arrived in the United States, as the U.S. has now surpassed China and other communist countries to become the world leader in spying on its citizens. It was announced this past week that Amazon Sidewalk has now joined the Helium Network allowing all Internet of Things (IoT) devices, which are currently in the homes of most Americans, to be connected into one large mesh network nationwide. The World Economic Forum's (WEF) goals for the 4th Industrial Revolution and Great Reset where nobody will own anything and be confined into 15-minute cities, is clearly a modern day Big Tech version of communism, where the rights of the individual are sacrificed for the rights of the community. This new system of surveillance, which is creating the ultimate police state, is well underway in the United States, which has, by far, the largest proportion of its population connected to the Internet, including cell phones, vehicles, cameras, and household appliances, than any other country in the world. Learn more about Big Tech's plans to monitor every aspect of your life and how to opt out.

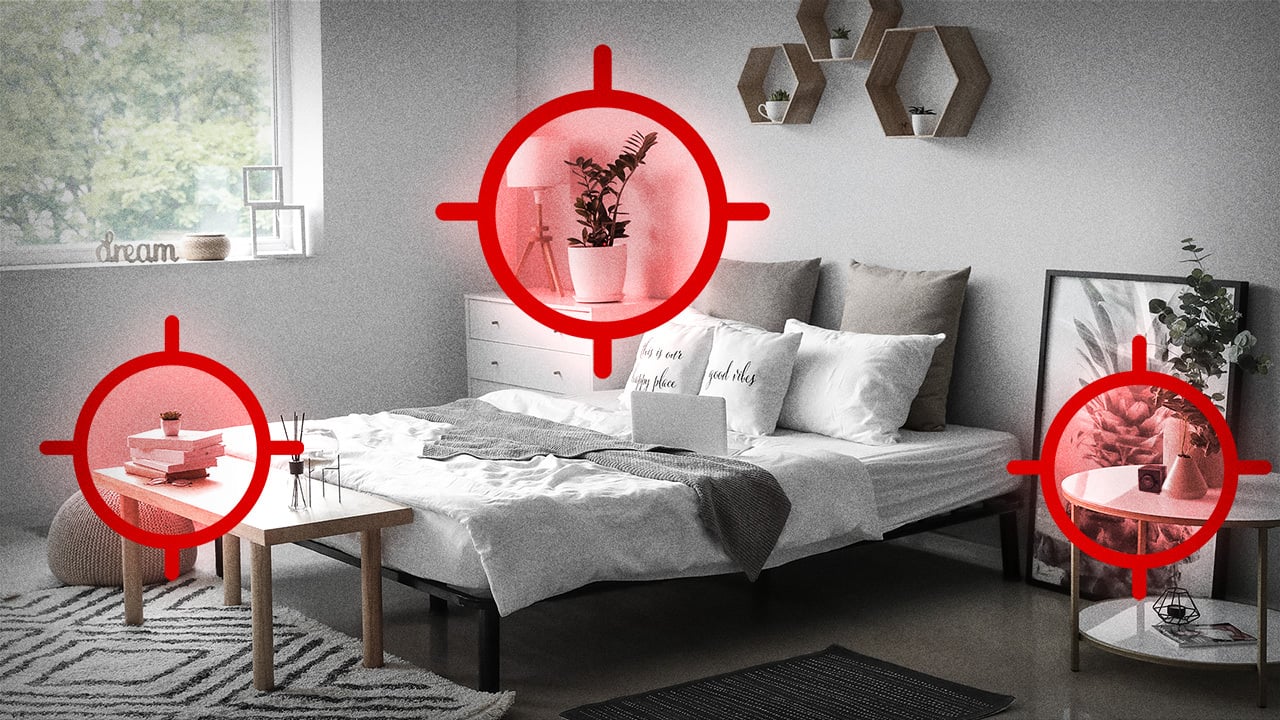

Does Your Airbnb Have Hidden Cameras? Here’s How to Check

Memorial Day is the traditional kickoff of the summer vacation season in the U.S. Over the past several years vacation rentals such as Airbnb have become popular alternatives to hotels, where people offer their private furnished homes (or rooms) for short-term rentals. PCMag states that many guests staying at these vacation rentals find hidden cameras in the homes, and they have just published an article with tips on what to do to make sure you are not being subject to surveillance when you stay in these residences.

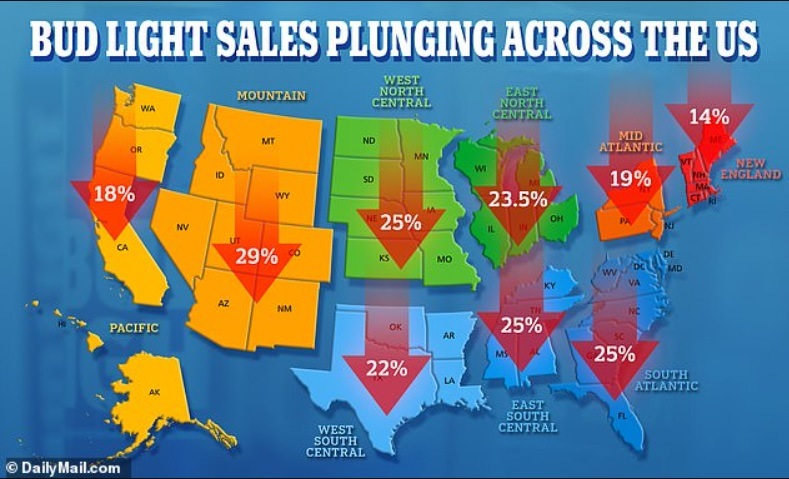

“Nobody Imagined it Would go on This Long”: Bud Light Sales Continue to Plummet over Mulvaney Backlash

The controversy, now nearing its third month, has turned off a broader customer group than just those who characterize themselves as conservatives. Sales of Bud Light continue to plummet, reflecting ongoing backlash to the brand's decision to hire transgender influencer Dylan Mulvaney as a spokesperson. According to data cited by the beverage industry trade publication Beer Business Daily, sales volumes of Bud Light for the week ending May 13 sank 28.4%, extending a downward trend from the 27.7% decline seen the week before. AB InBev shares have fallen more than 10% since Mulvaney's social media post went live. In a note to clients published Tuesday, JPMorgan analysts said that even if the decline in Bud Light sales stabilizes, "We believe there is a subset [of] American consumers who will not drink Bud Light for the foreseeable future.” "Nobody imagined it would go on this long," Schuhmacher said. He continued: "It seems random — it struck a nerve. I've never seen anything to compare it to, in all of the [consumer packaged goods] industry. It’s a real shock."

The Financial Fall of Budweiser Shows the Hidden Power that the American Consumer Still Has Over Wall Street Billionaires

Anheuser-Busch, the largest beer company in the world, is learning the hard way that the American consumer still has a hidden power against corporate America, as their company value has lost $15.7 billion since April 1st, when they hired transgender-influencer Dylan Mulvaney to promote their Bud Light beer, which sent sales diving all across the U.S. This has been truly historical, and I have to say I have never seen anything like this in my lifetime. More powerful than protests, even the "Occupy Wall Street" protests of 2011, and certainly more powerful than voting for politicians, the American consumer's most powerful voice for protest and change, is how they decide to spend their money, by voting in the only place that really matters, the marketplace. And let's be very clear here and give credit where credit is due. This is NOT simply a "conservative" protest, but this is a protest by AMERICANS that crosses political divides. And that is the main reason why a Wall Street corporate giant is reeling today, and trying to backpedal as fast as it can. Americans are rejecting the transgender culture, from trans "women" biological males invading sports and completely annihilating every female sports record on the books, to children committing suicide after receiving transgender medical procedures, to trans "women" biological male prisoners being incarcerated in women prisons and jails where rape and sexual abuse is skyrocketing, the majority of Americans are saying "this has gone too far." And in doing so by voting with their money, they are discovering the hidden power of the American consumer to fight back against the Wall Street billionaires and bankers.

Is The Federal Reserve Large-scale Human Behavioral Experiment since 2008 Coming to an End?

The Fed has trained the trading-rats all too well, and there is no way to avoid the unintended consequences of the Fed's large-scale human behavioral experiment.

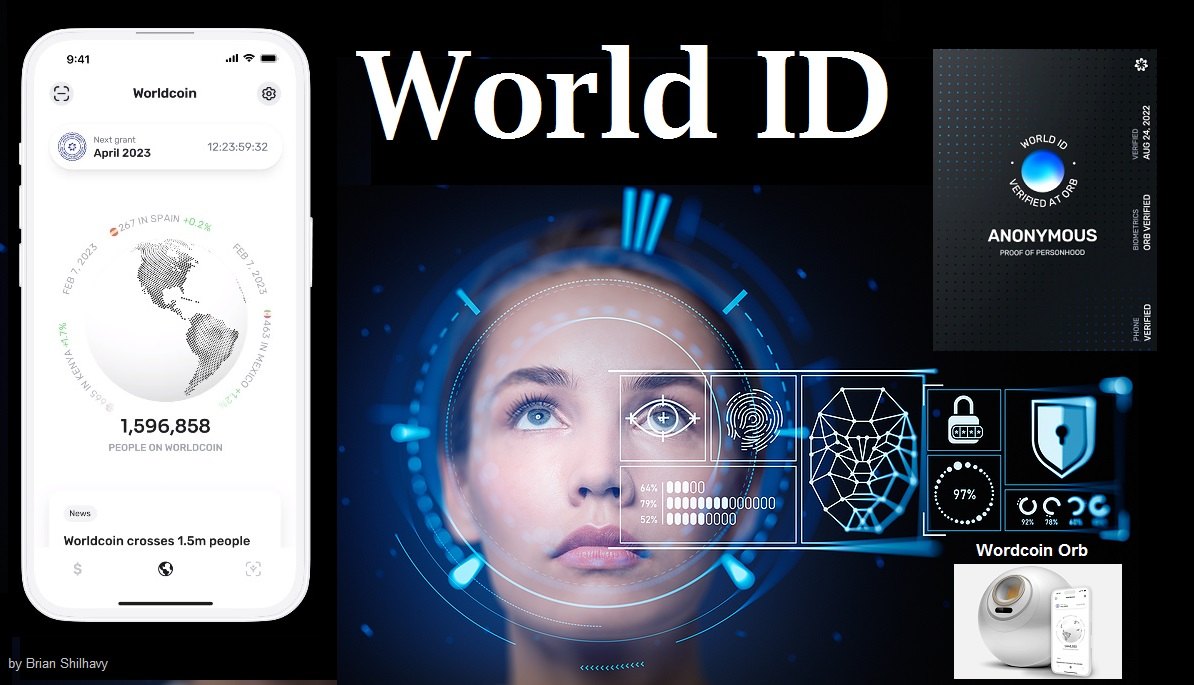

44% of Americans Now Using Biometrics Instead of Passwords to Log In to Their Accounts – We are Closer to a One World Financial System

A new report published by the FIDO Alliance states that 44 percent of Americans are now logging in to their online accounts with biometrics, rather than a password, and more than half of Americans today, 58 percent, state that they are interested in replacing their passwords with biometric passkeys. The FIDO Alliance report clearly states who is pushing the adoption of biometric passkeys at the beginning of their report: "It’s been a year since Apple, Google and Microsoft announced their commitment to passkeys with plans to expand support for a common passwordless sign-in standard created by the FIDO Alliance and the World Wide Web Consortium." The FIDO Alliance leadership and members are comprised of the biggest names in Big Tech and the financial sector, including Amazon.com, Microsoft, Google, Apple, Meta, Intel, Yahoo, American Express, Mastercard, Visa, Paypal, CVSHealth, U.S. Bank, PNC Bank, Wells Fargo, and many others. The most widespread biometric ID system currently being rolled out in many locations across the U.S. today is probably Amazon's palm scanning system called "Amazon One." A report published by Gizmodo today states that Amazon's palm scanning technology has now been updated to record your age, so you can purchase alcohol now without an ID by just letting them scan your hand. As I reported yesterday, the latest fad in the field of biometrics is Sam Altman's Worldcoin system and their "Orb" to scan people's eyes to create a unique "World ID". The system to produce a new one-world financial system is already in place, and it could happen now a lot quicker than most people realize.

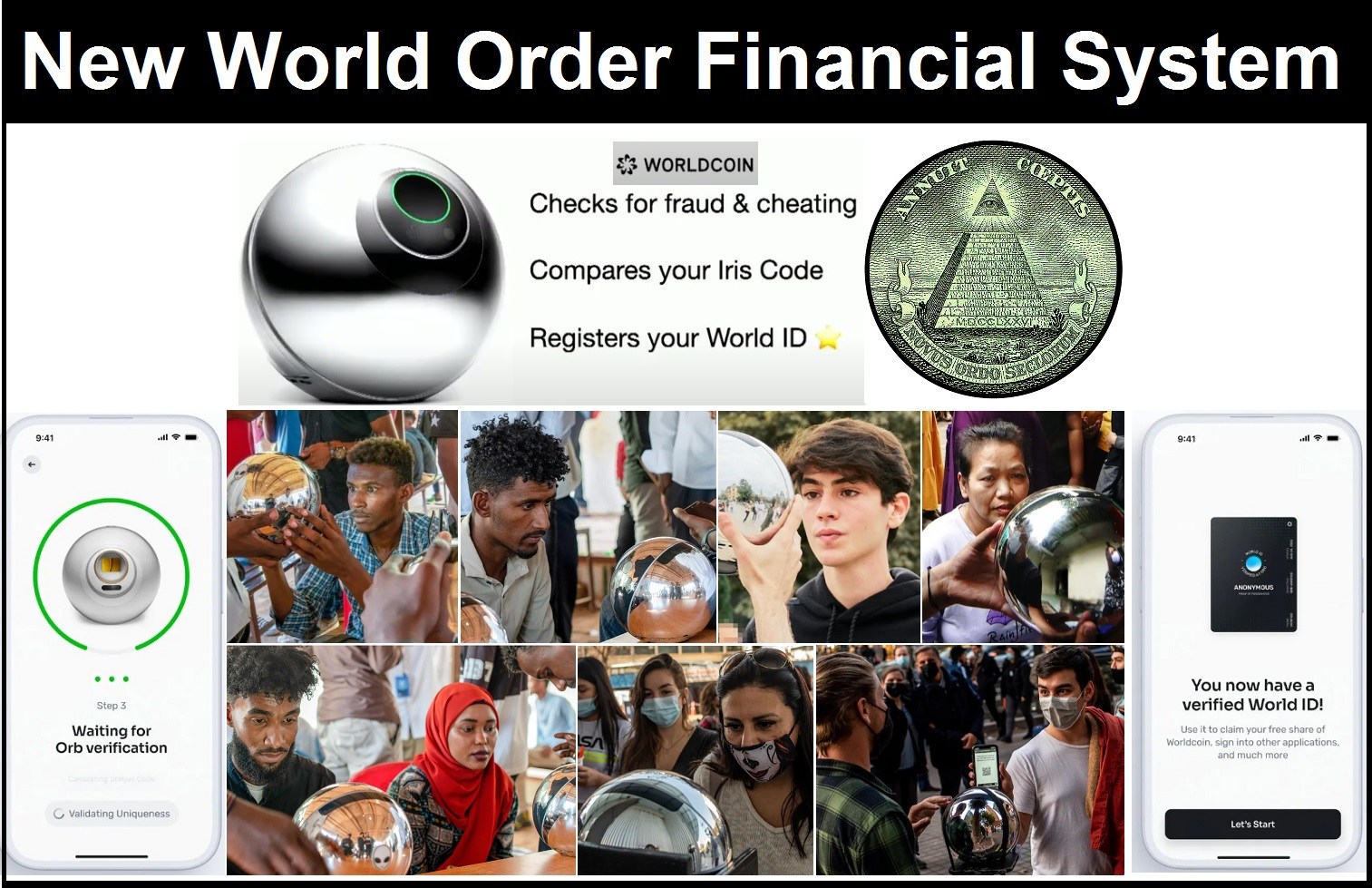

Get Ready for World ID and WorldCoin Universal Basic Income Offering Free Money in Exchange for Your Eyeball Scan

While the American public and even some U.S. politicians have been sounding the alarm recently over the dangers of the potential future rollout of Central Bank Digital Currencies (CBDCs), and the loss of all privacy in any financial transactions, a new blockchain financial network that was launched in 2019, before COVID, has been gaining momentum here in 2023 and is now being used in dozens of countries around the world with over 1.5 million users. And it is now being launched in the United States: World ID with the Worldcoin cryptocurrency. World ID is not some concept for the future. It is already here, and already being used around the world with the World App and Worldcoin, for both financial transactions and "World ID checks." Why have so many people around the world so quickly signed up for a World ID? Because they are being offered free cryptocurrency, and in some cases even free money in their local currencies, by using their new World ID. And what do they have to do to receive this free money? They just have to have their eyeball scanned by the Worldcoin "Orb" which will then create their unique World ID. Scanning one's eyeball seems like a pretty creepy way to create an ID, so what is the rationale to use one's eye as a biometric ID? It is to prove that "you are human" and not an AI, or so they say. This system is going to be rolled out in the United States within the next few weeks, so if you are not familiar with this network yet, I suggest you get up to speed ASAP. How fast could this World ID and World App program be rolled out? Well considering that the founder of Worldcoin and World ID is Sam Altman, the same person who created ChatGPT which last November became the fastest downloaded app in history with hundreds of millions of downloads, I think it is safe to conclude that this World ID could be rolled out very quickly.

Yellen: “More Bank Mergers Necessary” as Banks Lose Tens of $Billions in Deposits the Past Two Weeks

It appears that the Biden Administration is abandoning their rhetoric that "the banking system is fine." CNN reported today that Treasury Secretary Janet Yellen met with CEOs of large banks yesterday and told them that "more bank mergers may be necessary." Her statements killed a stock rally this week that saw the stocks of regional banks increase 10%, in one of their best weeks since 2020. Not anymore. As ZeroHedge News reported today, reports show that $billions of losses in deposits at U.S. banks have occurred in the past two weeks, with over $70 billion lost in large US Commercial Banks.