In 2003, Jamie Johnson, the son of billionaires and one of the heirs to the Johnson & Johnson fortune, produced a documentary about what it was like to grow up in the United States as a child of billionaires, where one has so much inherited wealth, that you never have to work, and how one can find meaning in life since money can't buy everything.

The name of the film is "Born Rich", and Johnson interviewed other children of billionaires, including Ivanka Trump.

While this is an interesting documentary, it is what "Born Rich" did for Jamie Johnson that led to his second documentary published in 2006 titled "The One Percent", that is far more interesting.

"The One Percent" documentary is very critical of the rich, from an insider perspective by the great grandson of Robert Wood Johnson I, co-founder of Johnson and Johnson.

Because Jamie Johnson was an insider into the world of the Globalists, and because he had decided to become a filmmaker and had already published his first documentary about the difficulties of being the child of billionaires, he basically had a free ticket to interview anyone he wanted to, as these very powerful people were probably trying to help out "one of their own" who was trying to find his way - at least until they realized just what it was he was trying to expose.

Some of the people Jamie interviewed for The One Percent are: Steve Forbes – CEO of Forbes, Inc., and former presidential candidate, Bill Gates Sr. – father of Microsoft Founder Bill Gates, Adnan Khashoggi – Iranian International arms merchant involved in the Iran-Contra scandal under President Reagan, Claude R. Kirk Jr. – former governor of Florida, Greg Kushner – Lido Wealth Conference Director, Nicole Buffett – adopted daughter of Warren Buffett's son Peter from a previous marriage, and Milton Friedman – Economist, and Nobel Laureate: 1976 winner of the Nobel Memorial Prize in Economic Sciences, among many others.

A couple of years after this documentary was published, the U.S. banking crisis started, and President George Bush and his predecessor President Barak Obama proceeded to bail out the banks and the Billionaires on Wall Street.

This led to the Occupy Wall Street protests in NYC at the end of 2011.

Unfortunately, the movement never gained traction and eventually just fizzled out, even though it was probably the only protest in my lifetime that actually identified the real problem in the United States that is behind almost every evil we suffer from: the Wall Street Billionaires and Central Bankers.

Why did this movement never pick up steam?

Because those Billionaires and Bankers did what they always do: they made it a political issue and part of one political platform, in this case the "Liberal Left", which then made the other half of the population of the United States, the "Conservative Right," automatically oppose it, so that the country remained divided and never dealt with the real criminals running the country, foolishly believing that politicians actually run this country and that if we don't like them, we can simply vote them out of office.

One of the most revealing parts of the documentary, which I just watched this weekend for the first time, was about how corrupt the sugar industry is in Florida. The sugar cane industry in the Florida Everglades is basically owned by one rich family, the Fanjul family, who uses the Government to protect their interests.

Attorney Greg Snell, who represents migrant farm workers working in the sugar cane fields, appears in this segment and states:

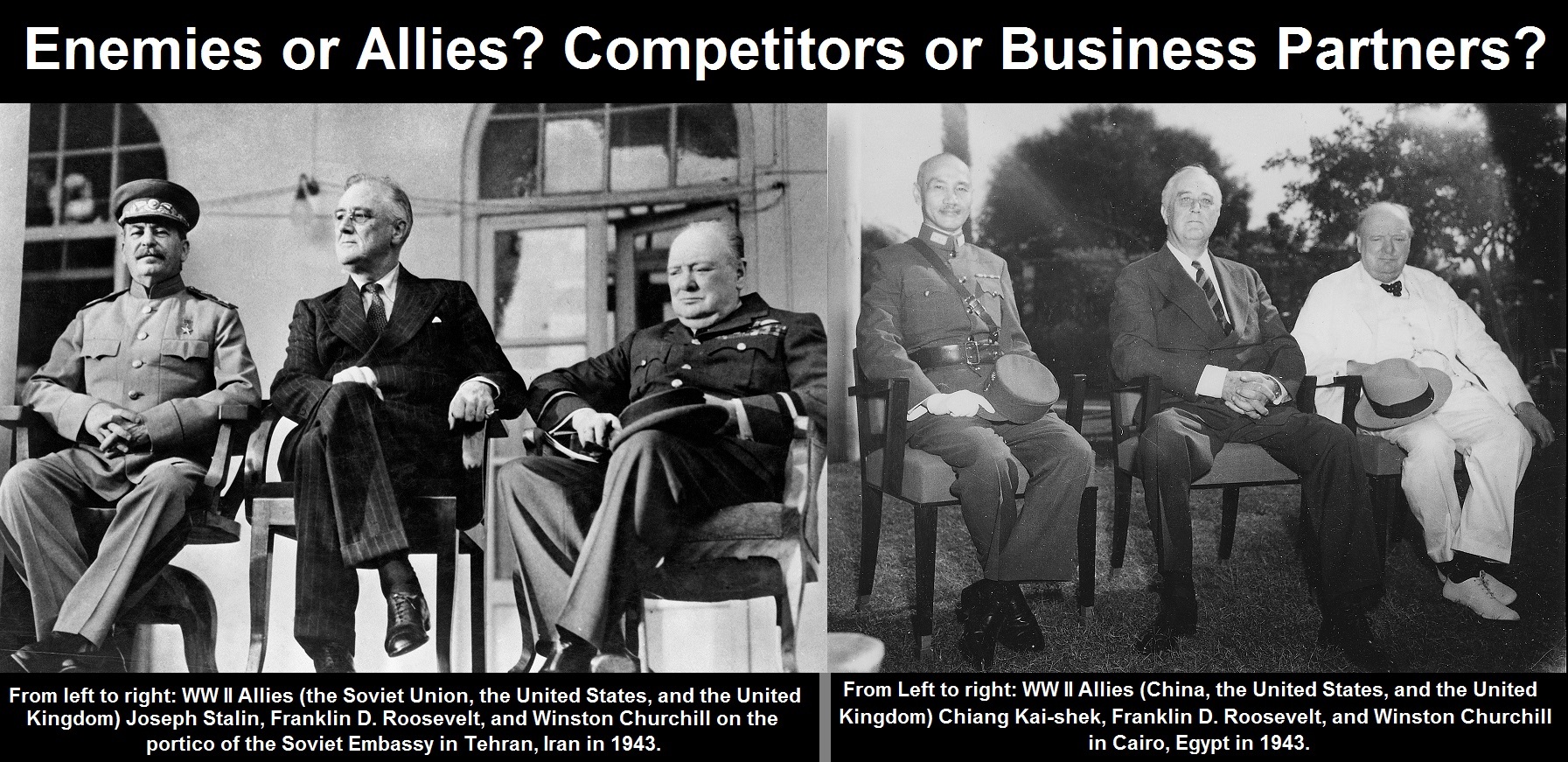

"One was the Republican one was the Democrat. Alfie Fanjul was the single largest contributor in Florida to the Clinton campaign, and his brother was the largest contributor to Republican Bob Dole campaign.

They had it covered either way."

This is an amazing film that I had not watched before this past weekend, and I was blown away by the information that is revealed in this documentary!

To be sure, it falls short of revealing the darkest and most evil elements of the Globalists who run this country, and topics like Satanic Ritual Abuse and child sex trafficking, or the role of Freemasonry and the Satanic Zionist Jews, but what it does reveal is how these people think, and how they justify their wealth, including Christians.