by Brian Shilhavy

Editor, Health Impact News

The Big Tech crash that I have been warning about since the last quarter of 2022, has now arrived, and it is crashing our entire economy.

It started in 2022 with the blowup of the Cryptocurrency Ponzi scheme called FTX, whose CEO now sits in prison serving a 25-year sentence for fraud and conspiracy. (Source.)

This started massive Big Tech layoffs that have continued through this year, and in March of 2023, some of the largest Big Tech Silicon Valley banks failed.

But a total collapse of the U.S. financial system was averted by a new Ponzi scheme, the AI bubble that I have been warning about for over a year and a half.

Now everyone is admitting that it has been a bubble all along as investors look to dump their technology stocks as quickly as possible, as the “Magnificent 7” companies (Apple, Google, Facebook, Amazon, NVIDIA, Microsoft, and Tesla) have now lost a combined $1.28 TRILLION in market cap over three sessions. (Source.)

Original image source ZeroHedge News.

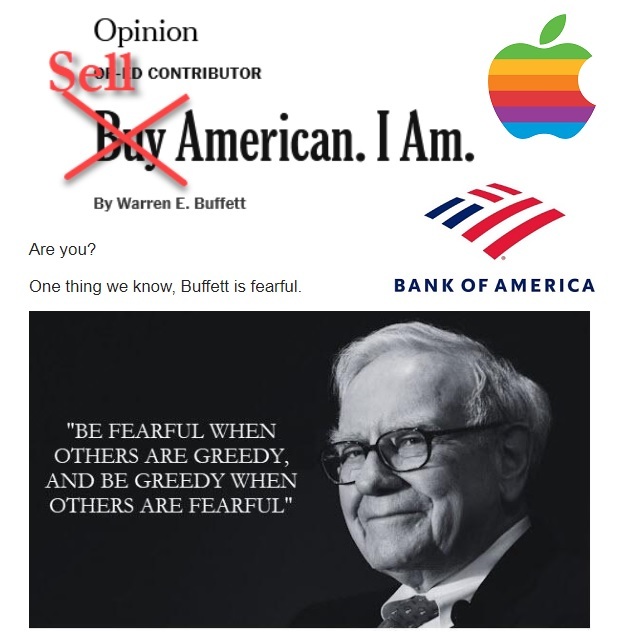

Last week it was widely published in the financial news that Warren Buffett was liquidating much of his stock in Bank of America, signaling serious trouble in the banking sector.

And then this weekend, after Friday’s stock market close, it was reported that Buffett had also been quietly liquidating shares in Apple Computers, one of his most iconic investments in the 21st Century, and for long periods of time holding the top position as America’s most valued stock.

Buffett Calls The Top: Berkshire Quietly Dumps Half Its Apple Shares Amid Unprecedented Selling Spree

When yesterday we said, when discussing Buffett’s ongoing liquidation of his Bank of America stake, that “Berkshire’s rising cash stockpiles merely reflect the firm’s inability to find deals in today’s overvalued and weak economic environment”, little did we know just how accurate that would be, because fast-forwarding just one day later we find that far from only dumping Bank of America, the 93-year-old Omaha billionaire had been busy quietly dumping his most iconic holding in an unprecedented selling spree that sent Berkshire’s cash pile soaring by a record $88 billion to an all time high $277 billion at the end of Q2.

As shown in the chart below, in the second quarter (which ended June 30, and thus just two weeks after the Apple’s Developer Conference which took place on June 10 and which was – at least on the day of – a total bust), Berkshire sold a net $75.5 billion worth of stock, the bulk of which we now know, came from Buffett’s liquidation of half his Apple shares.

While there was no 13F filed yet to go with the Berkshire’s 10Q, the company did provide a snapshot of its top holdings, revealing that as of June 30 it held only $84.2 billion in Apple stock, down sharply from $135.4 billion as of March 31 and $174.3 billion as of Dec 31, 2023. This translates into just 400 million shares of AAPL held as of June 30, down almost 50% from 789.4 million as of March 31 and 905.6 million as the end of 2023.

The rest of Berkshire’s top 5 holdings (Bank of America, American Express, Coca Cola and Chevron) was left untouched in Q2, meaning that Buffett clearly decided that it was time for Apple to go (we have since learned that subsequent to the end of Q2, Buffett also started to dump a large portion of his Bank of America shares where he is the single largest shareholder). (Full article.)

The catalyst that has seemed to kick off this latest selling spree in Big Tech with huge market losses since last week, was the Bureau of Labor Statistics (BLS) job report last week that showed fewer jobs were added to the economy in July than was expected, showing that the economy is probably now in a recession.

But ZeroHedge News has consistently reported how the BLS has been lying with their data, which they usually revise downward after the reports are released, and that almost all new jobs for the past year or so have been with migrant workers, and not U.S. citizens. This has helped fuel the stock market bubble which is mainly an AI bubble.

ZeroHedge also reported in April this year (2024) that the BLS was caught in a scandal where they were lying to the public, but sharing the real data with a secret group of Wall Street “Super Users.” See:

Scandal Rocks Biden’s Labor Dept For Lying About Sharing Non-Public Inflation Data With Secret Group Of Wall Street “Super Users”

So all of the “growth” in the economy we have been supposedly seeing since the AI boom that started at the beginning of 2023, has been based on LIES!

Many other Big Tech CEOs should also be investigated for fraud like Sam Bankman-Fried, and they should join him in prison for running a huge Ponzi scheme that has now defrauded the American public and put us on the precipice of total disaster.

Anyway, the purpose of this article is not to gloat and say “I told you so” for warning about this for almost 2 years while we are seeing it happen today in real time as Big Tech and the market crashes, but to warn you what is inevitably going to happen next, so you can be prepared before it happens:

Bank Bail-ins

Bank Bail-ins are the opposite of “bank bailouts”, which is what we saw with the bank failures in 2008.

With Warren Buffett’s Berkshire Hathaway now holding record amounts of cash on deposit, which we can safely assume is also happening at the other large investment firms now such as BlackRock, Vanguard, State Street, etc., banks will do everything they can to stop the bleeding soon, which means keeping their cash on deposit through bail-ins, where they can seize funds on deposit.

The laws are already in place to do this, as a Fortune article published just a few weeks ago explained.

Forget bailouts. Here’s how a bank ‘bail-in’ works

The recent collapses of Silicon Valley Bank and Signature Bank have done much more than inject uncertainty into public discourse about the banking sector. They have also sparked fear about bank solvency and political outrage over the potential for more bailouts.

An emerging but little-understood bank failure remedy called a bail-in has brought more confusion to the conversation. So let’s unpack bank bail-ins: what they do, who they affect, and what you need to know to protect your assets if a bail-in comes to your bank.

What is a bail-in?

A bail-in is a form of financial relief for banks that are in danger of collapsing or going bankrupt. The relief comes from canceling some or all of the bank’s debt by reducing the value of bank shares, bonds, and uninsured deposits. (Note: The Federal Deposit Insurance Corporation (FDIC) insures most bank deposits up to $250,000 per individual.)

A bail-in is the opposite of a bailout. Instead of relief funds coming from outside (taxpayers), the funds come from inside (shareholders and depositors). Although bail-in relief has been implemented in Europe, it has never been used in the U.S.

Even so, bail-in relief was legalized in the U.S. with passage of the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act, following the 2007–2008 financial crisis in which banks deemed “too big to fail” were bailed out by the U.S. government. The specific section of Dodd-Frank that deals with bail-ins is Title II: Orderly Liquidation Authority (OLA).

How does a bail-in work?

Bail-ins, which cancel a bank’s debt owed to creditors and depositors, serve as an alternative to bailouts.

“In my view, a bail-in appropriately forces investors to take risks before depositors, who do not do the same level of investigation on their financial institution when placing their funds in the bank,” says Gregory Garcia, chief operating officer of First Commerce Bank.

A bail-in can take place in the U.S. if the Secretary of the Treasury determines that the bank meets the conditions of a two-part test:

- The bank is in default, or in danger of default. A bank is in danger of default when it is likely to file for bankruptcy, has debt that will deplete all or most of its capital, has greater debts than assets, or will likely be unable to pay its debts in the normal course of business.

- The bank represents a systemic risk to the banking sector. The likelihood of systemic risk is based on the negative effect of default on financial stability; low income, minority, or underserved communities; and on creditors, shareholders, and counter-parties.

If, as a result of the evaluation, the Secretary and/or the bank’s board of governors believe the bank is a candidate for a bail-in, the board will vote on providing a written recommendation to the Secretary for the FDIC to be appointed receiver of the bank. (Full article.)

The FDIC insures individual bank accounts for up to $250,000. However, if you have cash invested into funds such as 401k or IRA managed retirement funds, those would most likely be at risk.

Also, even if you don’t technically lose your cash balance in an account on deposit in a bank account under $250,000, the bank still has other ways where they can hang on to your money longer, such as limiting withdrawals, or even closing the bank for a period of time as a “bank holiday” so customers with accounts on deposit cannot withdraw their funds.

In a worst-case scenario, they can reset the entire financial system and convert your federal reserve notes into digital currency, with all kinds of restrictions including requiring you provide a biometric scan of part of your body, such as a palm, face, or iris, in order to access your funds which would then become 100% traceable.

So what should you do?

I have been very public about what I have done with my business for the past year and a half, which is to keep as little money on deposit with the banks as possible, and invest in our core products which are food products, many of which can be stored long-term.

I have even extended an invitation to others to invest in our inventory as Resellers and Distributors. See:

Healthy Traditions Offers Up to a 20% Return on a $1000 Investment and Up to a 30% Return for $5000 Investment to Become Resellers of Long-term Storable Food Tested for GMOs and other Toxins

Many have taken us up on our offer, expanding our network nationwide.

Not everyone can do that, of course, but you should take a long, hard look at any debts you still have, and if possible, pay them off while you still can.

Do you still have car payments on a debt? Then if you can afford to, you should pay off that debt in lieu of keeping money in the bank, so at least you secure your vehicle if the banks fail. If you can’t afford to do that, look to trade in your vehicle as quickly as possible for one you can afford with no debt.

Same with paying off a mortgage on property, if you can. If you can’t, you probably do not want to pay down the debt, because you are in danger of losing it anyway.

Also prioritize paying off any credit card debt in lieu of keeping cash on deposit in a bank account.

Things Could Get a LOT Worse Very Soon!

Russian President Vladimir Putin with Supreme Leader of Iran Seyyed Ali Hosseini Khamenei. Image source.

As I write this on Monday, 8/5/2024, the entire world is waiting for Iran and their allies to strike back on Israel for assassinating Hamas Political Bureau Chief Ismail Haniyeh, who was visiting Tehran for the peaceful swearing in ceremonies of the new Iranian President, Massoud Pezeshkian last week. See:

Lie that Israeli Children Died in Golan Heights used by Zionist Israel to Assassinate Top Hamas Politician Who was Negotiating Peace

This attack is believed to be imminent, and it was reported today that a Russian defense delegation is now in Tehran.

Putin’s Top Defense Officials Are In Tehran Amid Countdown To Zero Hour

On Monday as the Middle East approaches zero hour of Iran’s expected major retaliation attack on Israel, there is a Russian defense delegation in Tehran, and a US defense delegation in Tel Aviv. How is that for symmetry among enemies?

Sergei Shoigu, Russia’s ex-Defense Minister and current national Security Council secretary, is meeting with senior Iranian military and security officials, as well as newly sworn-in president Masoud Pezeshkian.

Russia’s RIA Novosti news agency described the focus of the talks as “strengthening bilateral cooperation in a wide range of spheres including security” – and the meetings come amid growing speculation that Russia is actively helping the Islamic Republic to thwart potential Israeli attacks.

Russia has “strongly condemned” the killing of Hamas leader Ismail Haniyeh in Tehran last Wednesday. Iran considered the brazen act as tantamount to assassinating an official head of state while on an official visit. President Pezeshkian has meanwhile hailed Moscow as a “valued strategic ally.”

There has of late been much speculation that President Putin is ready to give greater support to America’s rivals and enemies in the Middle East as ‘payback’ for Washington’s support to Ukraine over the past more than two years. (Source.)

This event is incredibly significant, because while it is being reported that Netanyahu and others are now hunkered down in bunkers waiting for an Iranian missile and drone attack, these are the two countries, Russia and Iran, who have virtually nothing to lose from a total economic collapse of the U.S. economy, since the U.S. has placed restrictive sanctions on both countries for years now, including excluding them from the Western Banking system.

So instead of planning a direct attack on Israel, could they be planning an attack on the already faltering U.S. financial system??

As I reported over the weekend, there was a U.S. Senate hearing last week where a RAND publication revealed that U.S. defenses are not strong enough to defeat China in a direct war, pointing out our weaknesses against such things as cyber attacks.

This is obviously public information (purposely NOT classified), and information that Russia and Iran also now have.

Please make sure you have some cash on hand, access to water for a possible extended time, some food stored in case of a grid or Internet break down, and if possible a back up power source.

This could go south and get real ugly very quickly now.

Be prepared physically and emotionally/spiritually, and do NOT give in to fear.

Endure hardship with us like a good soldier of Christ Jesus.

No one serving as a soldier gets involved in civilian affairs—he wants to please his commanding officer. Similarly, if anyone competes as an athlete, he does not receive the victor’s crown unless he competes according to the rules. The hardworking farmer should be the first to receive a share of the crops.

Reflect on what I am saying, for the Lord will give you insight into all this.

Remember Jesus Christ, raised from the dead, descended from David. This is my gospel, for which I am suffering even to the point of being chained like a criminal.

But God’s word is not chained.

Therefore I endure everything for the sake of the elect, that they too may obtain the salvation that is in Christ Jesus, with eternal glory.

Here is a trustworthy saying: If we died with him, we will also live with him; if we endure, we will also reign with him. If we disown him, he will also disown us; if we are faithless, he will remain faithful, for he cannot disown himself. (2 Timothy 2:3-13)

Related:

Former Freemason Wall Street Manager Explains How the Banks Will Soon Take Your Money

This article was written by Human Superior Intelligence (HSI)

See Also:

Understand the Times We are Currently Living Through

New FREE eBook! Restoring the Foundation of New Testament Faith in Jesus Christ – by Brian Shilhavy

Who are God’s “Chosen People”?

KABBALAH: The Anti-Christ Religion of Satan that Controls the World Today

Christian Teaching on Sex and Marriage vs. The Actual Biblical Teaching

Exposing the Christian Zionism Cult

The Bewitching of America with the Evil Eye and the Mark of the Beast

Jesus Christ’s Opposition to the Jewish State: Lessons for Today

Identifying the Luciferian Globalists Implementing the New World Order – Who are the “Jews”?

The Brain Myth: Your Intellect and Thoughts Originate in Your Heart, Not Your Brain

What is the Condition of Your Heart? The Superiority of the Human Heart over the Human Brain

The Seal and Mark of God is Far More Important than the “Mark of the Beast” – Are You Prepared for What’s Coming?

The Satanic Roots to Modern Medicine – The Image of the Beast?

Medicine: Idolatry in the Twenty First Century – 10-Year-Old Article More Relevant Today than the Day it was Written

Having problems receiving our emails? See:

How to Beat Internet Censorship and Create Your Own Newsfeed

We Are Now on Telegram. Video channels at Bitchute, and Odysee.

If our website is seized and shut down, find us on Telegram, as well as Bitchute and Odysee for further instructions about where to find us.

If you use the TOR Onion browser, here are the links and corresponding URLs to use in the TOR browser to find us on the Dark Web: Health Impact News, Vaccine Impact, Medical Kidnap, Created4Health, CoconutOil.com.

Join the Discussion