by Ronan Manly

Bullionstar.com

One of the most potentially far-reaching trends in the financial landscape right now is the imminent roll-out of Central Bank Digital Currencies (CBDCs), and the parallel attacks which central bankers are waging on private digital currencies and tokens as they tee up the launch of their CBDCs.

First some clarifications. While the majority of central bank issued currencies (fiat currencies) in existence around the world are already in digital form, a fiat currency held in digital form is not the same as a Central Bank Digital Currency (CBDC).

What is a CBDC?

A CBDC generally refers to electronic or virtual central bank (fiat) money that is created in the form of digital tokens or account balances which are digital claims on the central bank. CBDCs will be issued by central banks and will be legal tender.

Many CBDCs that are being researched and developed employ Distributed Ledger Technology (DLT), with the recording of transactions on a blockchain.

However unlike private cryptocurrencies which use a permissionless and open design, CBDCs that use DLT will use permissioned variants (deciding who has access to the network and who can view and update records in the ledger). See here for a discussion of permissionless vs permissioned blockchains.

Critically, as the name suggests, CBDCs will be centralized and governed by the issuing authority (i.e. a central bank). So, in their design and structure, CBDCs can be viewed as the very antithesis to decentralized private cryptocurrencies and tokens.

Central banks are already working on two types of CBDCs, ‘wholesale’ digital tokens that would have access restricted to banks and financial entities to be used for activities like interbank payments and wholesale market transactions, and ‘general purpose’ (retail) CBDC for the general public to be used in retail transactions.

It is this ‘general purpose’ CBDC which most people are referring to when they discuss central bank digital currencies, and it is these ‘general purpose’ CBDCs that will be most important to watch when central banks and governments begin to attempt their roll-outs to distribute CBDCs to billions of people across the world either through account-based CBDCs or ‘digital cash’ tokens.

As you can guess, account-based CBDCs will be tied to user identities and Digital IDs, and straight off the bat they allow for total surveillance by the State and torpedo any chance of anonymity. For this reason, they are already a favourite among central banks. Given that CBDCs will be centralized ledgers and can be programmable, the ‘digital cash’ token option is not much better in terms of privacy and freedom.

The Bank for International Settlements – The Dark Tower of Basel.

Many central banks will probably opt for a hybrid model of both account-based and token based digital cash. As an example, Canada, the one time liberal democracy, perhaps illustrates the account-based vs token based choices best, where Canada’s central bank, the Bank of Canada, in its design documentation for CBDCs shows that at the end of the day, it’s about surveillance and control, saying that:

“anonymous token-based options would be allowable for smaller payments, while account-based access would be required for larger purchases.”

Central banks are also experimenting with various models for distribution of CBDCs to the masses, including using private commercial banks and payment providers who will intermediate on the central banks’ behalf, and also direct distribution of payments by a central bank to a population. Either way, you can see that CBDCs greatly facilitate the statists to advance their Orwellian plans for Universal Basic Income (UBI) and dependency on the state.

Accelerating rollout

CBDCs are not just a buzzword or a hazy innovation that may appear sometime in the distant future. They are actively being developed now, and in widespread fashion.

In January 2020, the Bank for International Settlements (BIS) issued the results of a survey on CBDCs that it had conducted in the second half of 2019, and to which 66 central banks had responded. Strikingly, 10% of central bank respondents (which represented a fifth of the world’s population) said that they were likely to issue a ‘general purpose’ CBDC (for the general public) in the near future (within the next 3 years). Another 20% of central bank respondents said they would likely issue a ‘general purpose’ CBDC in the medium term (within 6 years).

In August 2020, the BIS published a comprehensive working paper on CBDCs titled “Rise of the central bank digital currencies: drivers, approaches and technologies” one part of which analysed the BIS database of central banker speeches and found that between December 2013 and May 2020, there had been 138 central banker speeches mentioning CBDCs, with a dramatic increase in CBDC related speeches since 2016, a timeframe which coincided with central banks launching research projects on CBDCs. The same BIS report also highlighted that, (totally coincidentally) the Covid-19 ‘pandemic’ “accelerated work on CBDCs in some jurisdictions.”

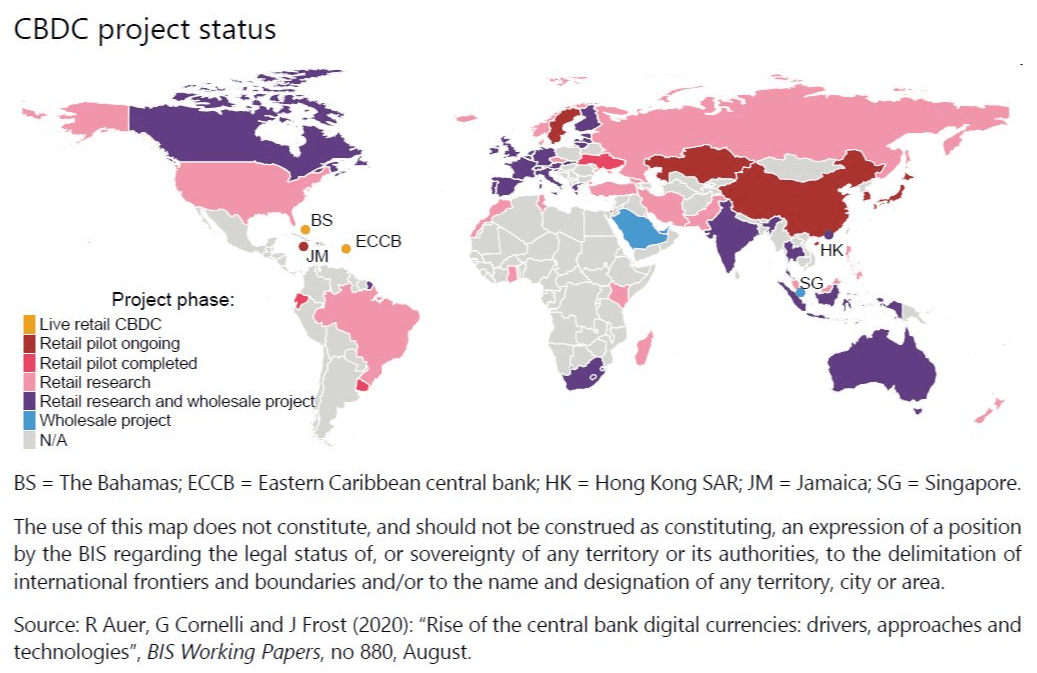

BIS slide on CBDC global project status – August 2021. Source.

Fast forward to right now, and on the website of the globalist Atlantic Council (headquartered in Washington D.C.), there is an interesting Central Bank Digital Currency Tracker which lists all the countries that have either launched or piloted a CBDC or are developing or researching a CBDC.

Here we find that 5 central banks have already launched a CBDC, 14 have a CBDC in pilot, 16 have a CBDC in development, and another 32 central banks are at the research stage with their CBDC. That makes 67 central banks (countries in total). While the 5 currency areas that have already launched a CBDC are all islands in the Caribbean, the central banks at the pilot stage include heavy weights such as China, South Korea, Thailand, Saudi Arabia and Sweden.

Those at the development stage include the central banks of Canada, Russia, Brazil, Turkey, France and Nigeria. Those at the research stage include the central banks of the US, UK, Australia, Norway, India, Pakistan and Indonesia.

So as you can see, this is not some theoretical issue. Centrally controlled digital currencies are coming down the pipe in a big way, and some will be appearing, if not imminently, then very soon. And given the ease with which governments have imposed lockdowns and restrictions on their compliant populations during 2020 and 2021, it is not hard to envisage that these same pliable masses will be easily influenced to embrace CBDCs as being in their ‘best interests’.

BIS Switzerland – The Usual Suspect

In fact, one third of the entire BIS annual report 2021 is focused on CBDCs in a section titled “CBDCs: an opportunity for the monetary system”.

Here, the BIS predictably trumpets the benefits of introducing central bank issued centralized digital currencies while at the same time attempting to undermine private cryptocurrencies. The BIS wording reveals the fact that central banks are in panic over the competitive threat of private cryptos and have accelerated the development of CBDCs partially due to this fear, with the BIS stating that:

“Central bank interest in CBDCs comes at a critical time. Several recent developments have placed a number of potential innovations involving digital currencies high on the agenda.

The first of these is the growing attention received by Bitcoin and other cryptocurrencies; the second is the debate on stablecoins; and the third is the entry of large technology firms (big techs) into payment services and financial services more generally.”

The BIS then attempts to dismiss each of these 3 threats:

Cryptocurrencies, claims the BIS “are speculative assets rather than money, and in many cases are used to facilitate money laundering, ransomware attacks and other financial crimes”.

Bitcoin comes in for some special mention with the BIS saying that “Bitcoin in particular has few redeeming public interest attributes when also considering its wasteful energy footprint’.

Stablecoins, says the BIS “attempt to import credibility by being backed by real currencies” that are “ultimately only an appendage to the conventional monetary system and not a game changer.”

The entry of large tech firms that dominate social networks, search, messaging, and e-commerce into the realm of financial services and payments provision infrastructure seems to especially bother the BIS, and it spins it’s criticism into the argument that although these platforms have large network affects, this creates “further concentration” in the market for payments.

The irony is not lost on the fact that it’s the BIS, as the central bank of central banks and one of the most concentrated power centres in the world, that is criticizing others’ “concentration” of power.

Throughout this CBDC pitch, the BIS report refers at numerous points that digital currencies should be “in the public interest”, which really means that digital currencies should be controlled by the BIS and its central bank members, as well as perpetuate their centralized monetary power structure.

The BIS even has the gall to claim that CBDCs should respect privacy rights, when in fact the whole architecture, rationale and design of central bank digital currencies will allow central banks and national authorities to invade totally on privacy rights.

But sometimes the BIS lets its guard down, and reveals its authoritarian plans for CBDCs. A case in point is a recent interview with Agustín Carstens general manager of the BIS, where he chillingly said:

“We don’t know who’s using a $100 bill today and we don’t know who’s using a 1,000 peso bill today.

The key difference with the CBDC is the central bank will have absolute control on the rules and regulations that will determine the use of that expression of central bank liability, and also we will have the technology to enforce that.”

See video segment below for Carstens’ remarks:

Same Song Sheet

With the BIS is Basel Switzerland as the conductor and orchestrator, it’s not surprising that central bank governors and country heads are now singing from the same song sheet, the song being ‘private digital currencies bad, central bank digital currencies good’.

Earlier this month (September 2021) at a banking conference in Stockholm, the governor of Sweden’s central bank (Riksbank), Stefan Ingves, commented that ‘private money usually collapses sooner or later’, while conveniently failing to mention the hundreds of government and central bank issued paper currencies that have collapsed throughout history due to overprinting, depreciation and hyperinflation. Nor did Ingves mention Voltaire’s famous quote that “Paper money eventually returns to its intrinsic value – zero”.

Ingves, whose country is one of the leaders in promoting a cashless society, also took a derogatory swipe at Bitcoin saying “sure, you can get rich by trading in bitcoin, but it’s comparable to trading in stamps.” All the while the Riksbank is pushing ahead with it’s central bank digital currency, called the e-krona, a CBDC which uses distributed ledger technology, and which the Swedish central bank is currently testing in conjunction with Handelsbanken, one of Sweden’s largest retail banks.

In the same week as Ingves’s comments in Sweden, the governor of Mexico’s central bank, Alejandro Diaz de Leon, was also taking a shot at private cryptocurrencies and for good measure he also put the boot into precious metals.

Diaz de Leon said that Bitcoin is more like a method of barter than ‘evolved’ fiat money, and continued “in our times, money has evolved to be fiat money issued by central banks. Bitcoin is more like a dimension of precious metals than daily legal tender.”

That comment, which attacks two birds with one stone (crypto and precious metals), will definitely please his central bank governor colleagues at thee BIS, and may even earn Diaz de Leon a nomination as the next BIS general manager, to succeed his fellow countryman Agustín Carstens.

Speaking of the BIS, Benoit Coeure, head of the BIS Innovation Hub, also gave a WEF style speech about CBDCs in early September, acknowledging the convenient catalyst of the covid ‘pandemic’, and the accelerated development of CBDCs by central banks:

“the world is not returning to the old normal. Payments are a case in point. The pandemic has accelerated a longer-running move to digital …. the world’s central banks are stepping up efforts to prepare the ground for digital cash – central bank digital currency (CBDC):

“A CBDC’s goal is ultimately to preserve the best elements of our current systems while still allowing a safe space for tomorrow’s innovation. To do so, central banks have to act while the current system is still in place – and to act now.”

Turkey’s president, Recep Tayyip Erdoğan, also recently joined in the attack on private digital currencies, while simultaneously promoting Turkey’s CBDC. At an event on 18 September, the Turkish president stated that:

“we have absolutely no intention of embracing cryptocurrencies”

“on the contrary, we have a separate war, a separate fight against them. We would never lend support to [cryptocurrencies]. Because we will move forward with our own currency that has its own identity.”

PBOC SAYS ALL CRYPTO-RELATED TRANSACTIONS ARE ILLEGAL

So the digital yuan is a complete disaster eh?

— zerohedge (@zerohedge) September 24, 2021

China: Digital Yuan – An Ominous Blueprint

A huge red flag over CBDCs and user privacy is that these central bank digital currencies are programmable, as details on China’s ‘Digital Yuan’ already show.

For example, the Digital Yuan can be programmed to be activated on a certain date, programmed to expire on a certain date, programmed to be only valid for certain purchases, and ominously, programmed to be only available to citizens who meet certain pre-conditions.

As a potential blueprint for other CBDCs, people across the world need to sit up and take notice, because the issuing authorities of these CBDCs coming down the pipe can therefore decide who gets access to CBDCs, what they can transact using those currencies, and how long the purchasing power remains valid.

Central Banks can thus influence and control the behaviour of the recipients of this centralised digital cash, as well as exclude those who they want to penalize or who don’t comply with the State’s rules or parameters.

And right on cue as this article was just published, Chinese authorities have now announced (on 24 September) a total ban on all cryptocurrency transactions. Except of course, it’s upcoming authoritarian Digital Yuan.

Conclusion

Although central banks will claim that they are introducing CBDCs for reasons such as improving payments efficiency, boosting financial inclusion for the unbanked and tackling illicit transactions, their real motivations, as always, are for surveillance and control.

Surveillance of a population via complete visibility into financial transaction flow and user identities, and centralized control of the money supply within a cashless financial system.

Think China’s social credit system on a global dystopian scale, where vax passes evolve into digital IDs and digital IDs link to CBDC issuance and use. In fact, the entire coercion around implementing vaccine passports and digital IDs looks to be a pre-planned stepping stone for the roll-out of central bank digital currencies and global social credit systems.

The timing of the accelerated emergence of CBDCs may partially be an attempt by central banks to outflank the numerous private cryptocurrencies, tokens and decentralized finance ecosystems that have emerged and that are a threat to the power of the centralized banking system at whose apex sits the BIS.

But it would be naïve to think that central banks that knew in advance about the initiation of a‘WEF’ global technocratic and corpocratic takeover that would begin in 2020, are not now orchestrating the rollout of CBDCs as part of a long-term global agenda, that agenda being the global socialist Agenda 2030, and a future in which, according to the Davos World Economic Forum (WEF) “You’ll own nothing. And you’ll be happy”.

BIS and central bank attacks against private cryptocurrencies are to be expected. After all, the same central banks and the BIS have waged a very long war against physical gold and silver. And precious metals have been money since 4000 B.C..

With the launch of CBDCs by central banks and their elitist private banking controllers, that war looks set to intensify. So, do you want a future of monetary freedom, or a future of perpetual slavery to central banker CBDCs?

Read the full article at Bullionstar.com.

See Also:

Understand the Times We are Currently Living Through

American Christians Want a New Jewish King to Become Slaves Instead of Serving Jesus Christ in Freedom

Where is Your Citizenship Registered?

American Christians are Biblically Illiterate Not Understanding the Difference Between The Old Covenant vs. The New Covenant

Exposing the Christian Zionism Cult

Jesus Would be Labeled as “Antisemitic” Today Because He Attacked the Jews and Warned His Followers About Their Evil Ways

Insider Exposes Freemasonry as the World’s Oldest Secret Religion and the Luciferian Plans for The New World Order

Identifying the Luciferian Globalists Implementing the New World Order – Who are the “Jews”?

The Brain Myth: Your Intellect and Thoughts Originate in Your Heart, Not Your Brain

Fact Check: “Christianity” and the Christian Religion is NOT Found in the Bible – The Person Jesus Christ Is

Was the U.S. Constitution Written to Protect “We the People” or “We the Globalists”? Were the Founding Fathers Godly Men or Servants of Satan?

The Seal and Mark of God is Far More Important than the “Mark of the Beast” – Are You Prepared for What’s Coming?

The Satanic Roots to Modern Medicine – The Mark of the Beast?

Medicine: Idolatry in the Twenty First Century – 8-Year-Old Article More Relevant Today than the Day it was Written

Having problems receiving our emails? See:

How to Beat Internet Censorship and Create Your Own Newsfeed

We Are Now on Telegram. Video channels at Bitchute, and Odysee.

If our website is seized and shut down, find us on Telegram, as well as Bitchute and Odysee for further instructions about where to find us.

If you use the TOR Onion browser, here are the links and corresponding URLs to use in the TOR browser to find us on the Dark Web: Health Impact News, Vaccine Impact, Medical Kidnap, Created4Health, CoconutOil.com.

2 Comments