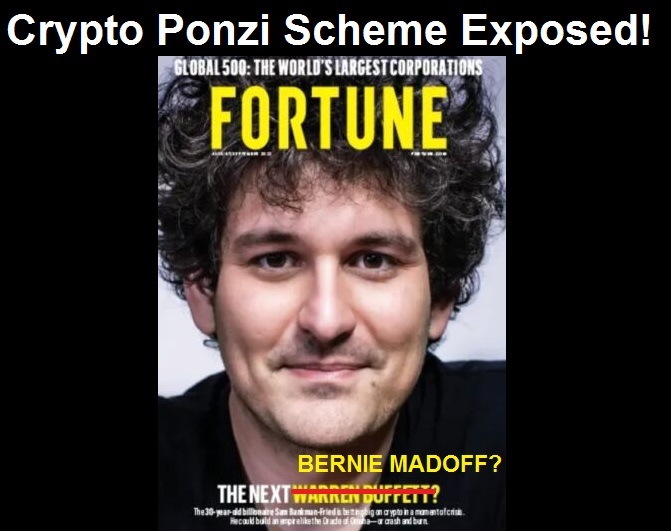

Biden’s DOJ Arrests Bankman-Fried in Unprecedented Move to Prevent Him from Incriminating Himself Before Congress

Within one day the entire narrative surrounding the downfall of Billionaire Crypto King Sam Bankman-Fried has gone from "why hasn't this guy been arrested yet," to "what is the government afraid he is going to reveal?" Who all is this guy connected to, and just how far does the corruption spread? Yesterday, one day before he was scheduled to appear in Congress before Maxine Waters, the DOJ issued an arrest warrant and authorities in the Bahamas, finally, arrested Bankman-Fried. But now he can't testify before Congress. According to criminal defense attorney Jonathan Turley, this is unprecedented. Never before has the plaintiff in a criminal case, in this case the U.S. Department of Justice, intervened to prevent a defendant from testifying before Congress where he would have undoubtedly incriminated himself and made their case a slam dunk. I think this bizarre story has now gone from "will he be arrested" to "will he be suicided away, like Jeffrey Epstein, to protect the guilty?"