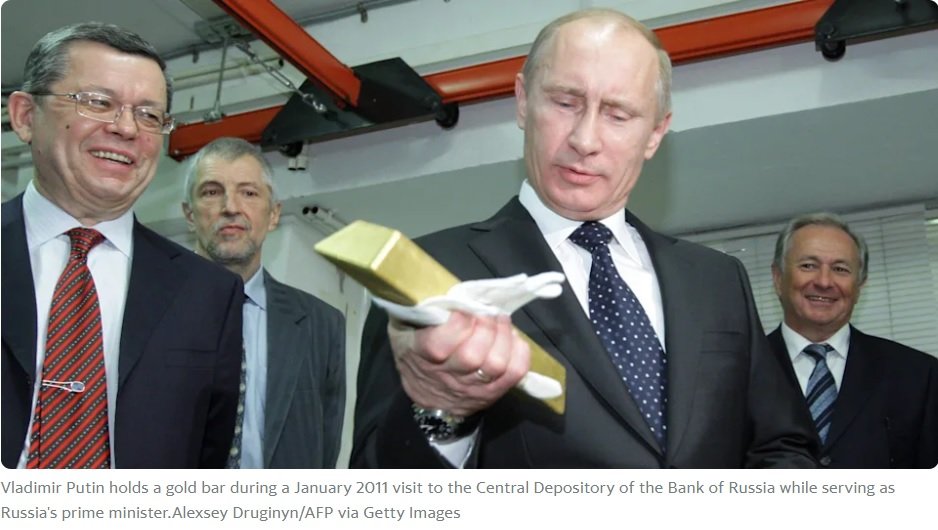

Will Russia Backstop The Ruble With Gold?

Now that Russia has come right out and said it will only transact in Rubles when selling oil to “unfriendly” nations, I’m expecting gold to be the next safe haven for the nation to fall back on, as it desperately tries to backstop both its currency and its economy. The backstopping of the Ruble with gold can come in many forms and doesn’t have to be a direct peg from the Ruble to gold - it can also include the far more likely scenario of accepting payment for oil, the country’s most ubiquitous and valuable resource, in gold. A new directive from President Vladimir Putin saw the Russian leader say in a televised government meeting yesterday: "I have decided to implement ... a series of measures to switch payments — we'll start with that — for our natural gas supplies to so-called unfriendly countries into Russian rubles.” I said last month that Putin would push back on economic sanctions by “allying himself further with China, and even discussing with China the prospects of a monetary system outside of the current global monetary system.” Tying the Ruble directly to oil makes it “sound money” of sorts, because it is tied to a commodity with demand which ostensibly will help buoy demand for the currency. Demand for gold in Russia could continue to be voracious, especially now that the West is considering sanctions on Russia’s gold, including preventing the country from selling gold on international markets. Hilariously, the New York Times reported that U.S. Senators consider Russia’s gold to be a “loophole” in sanctions against the country: "The senators suggested that Russia’s $130 billion worth of gold reserves were a loophole in the sanctions that were imposed on Russia’s central bank. They said that Russia was laundering money through gold by buying and selling it for high-value currency." But it isn’t a loophole: this is the reason gold is a safe haven. There’s almost always going to be a bid for it somewhere - that’s part of what makes it sound money. And so preventing Russia from selling their gold actually does them a favor, of sorts, and encourages them to continue to build their stockpile. In fact, removing supply from the market may only serve to help gold’s price in dollars rise, potentially.