57 Banks and Financial Institutions Certified for FedNow Instant Payments – Fed President Admits Withdrawals Can be Limited

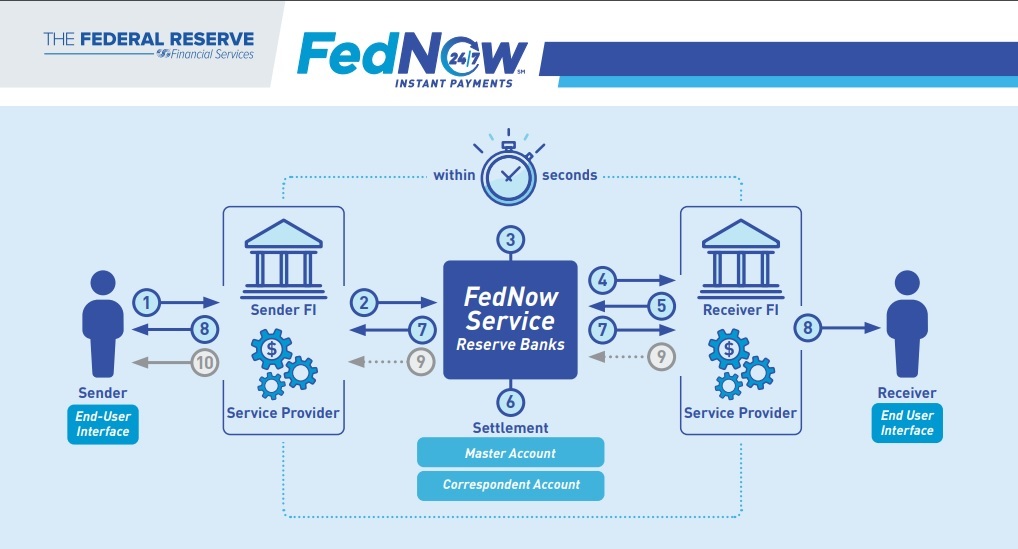

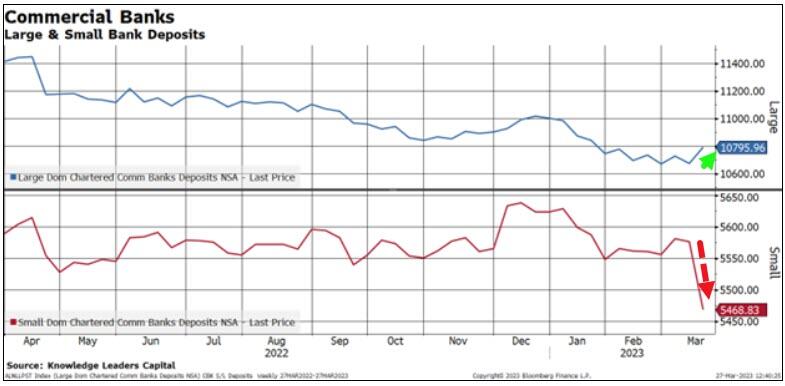

57 "early adopter organizations" have now been certified to participate in the U.S. Federal Reserve's FedNow instant payments program that will be rolled out later this month (July, 2023). Cleveland Federal Reserve President Loretta Mester stated yesterday that the FedNow program "should help ensure financial stability should bank stress arise," by limiting withdrawals. Last month (June, 2023), I reported how The Consumer Financial Protection Bureau (CFPB), an organization linked to the Federal Reserve, published a warning to consumers stating that funds held in popular online payment apps, such as Paypal, Cash App, and Venmo, lack FDIC insurance and should be transferred to “insured banks and credit unions.” I posed the question as to whether or not the Fed was getting ready to eliminate these apps in favor of FedNow, and wrote: "The Fed is basically warning you ahead of time that you are going to lose that money if you keep it there." And sure enough, Cleveland Federal Reserve President Loretta Mester did address this issue in her update on FedNow yesterday, stating that "it may seem more efficient to have fewer rails for smaller-transaction payments."