The U.S. national debt has topped $31.2 trillion. Tack on the debt of households, businesses, state and local governments, and financial institutions, and you’re looking at a total U.S. debt over $92.9 trillion.

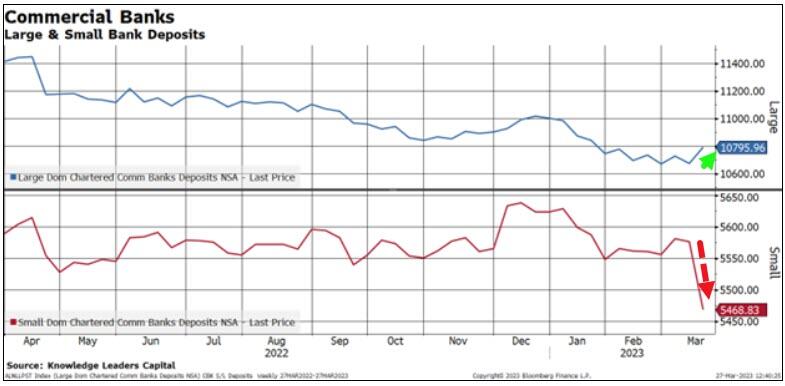

As the Fed hikes interest rates to contain the raging inflation of its making, the cost of servicing government debt increases. Total U.S. tax revenue is approximately $4.9 trillion. Total U.S. interest paid is over $3.4 trillion. Before long it will take 100 percent of tax revenue just to service the debt interest.

Then what?

The popular American myth is that the U.S. government has never defaulted on its debt. Quite frankly, that’s an unadulterated lie. The U.S. government has (unofficially) defaulted on its debt twice within the last hundred years.

Executive Order 6102 of 1933, which forced all American citizens to turn in gold coins and bars, was, in fact, a default. Gold ownership in the United States, with some small limitations, was illegal for the next 40 years.

The second default occurred in 1971, when President Nixon “temporarily” suspended the convertibility of the dollar into gold.

Prior to 1971, as determined by the Bretton Woods international monetary system, which was agreed to in Bretton Woods, New Hampshire, in July 1944, a foreign bank could exchange $35 with the U.S. Treasury for one troy ounce of gold. After the U.S. reneged on this established exchange rate, when foreign banks handed the U.S. Treasury $35, they received $35 in exchange.

In both instances, the U.S. government didn’t overtly default on the debt. Instead, it changed the fundamentals – the terms and conditions – of the dollar. By all honest accounts, these are defaults.

What dirty trick does Uncle Sam have up his dirty sleeve this time?

One possible swindle is the issuance of a digital dollar – a Fed or government issued central bank digital currency (CBDC) – which is traceable and programmable. When it is introduced, your accounts will be credited one for one, as in one federal reserve note for one digital dollar. But what you’ll be able to buy in return with your digital dollars will be far less.

You see, the digital dollar roll out will provide elaborate cover.

Make no mistake. This is a default. And it is coming much sooner than you think.

Are you ready?