Are Risks from Bank “Bail-ins” Increasing? “Shadow Banks” are now 49% of Global Assets

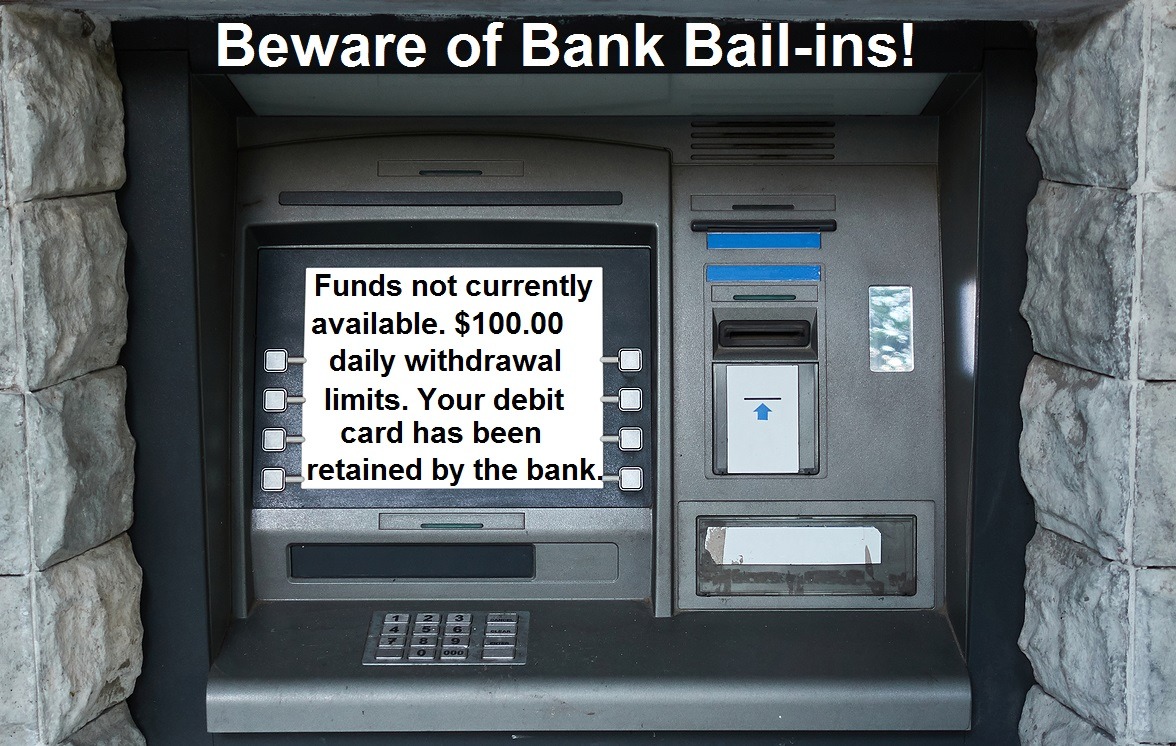

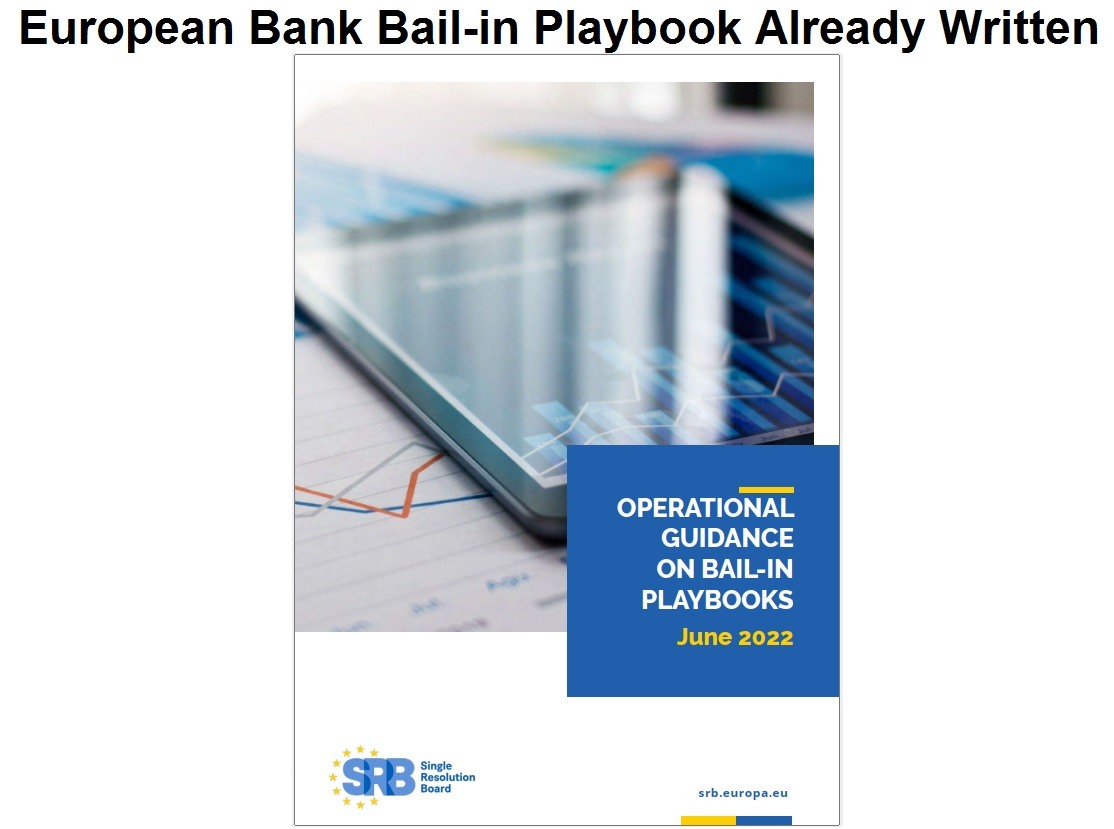

Back in 2023 when several U.S. Banks, mostly banks with high exposure to Silicon Valley Big Tech accounts, started to collapse, I published some articles explaining the concept of bank "bail-ins", which are the opposite of bank "bail-outs" where the U.S. Government bails out "too-big-to-fail" banks that collapse, as we saw in 2008. Bank bail-ins are the opposite, and allow banks to secure non-FDIC insured funds in accounts of bank depositors. Most Americans are unaware of the fact that laws are now in place to seize funds on deposit in U.S. Banks from account holders. There was a threat in 2023 of the total collapse of the U.S. banking system, but it survived, at least temporarily. Talk is again picking up about the possibility of bank bail-ins here in 2025 in Trump 2.0. Much of this chatter is coming from "Gold Bugs" who make their living selling gold, as a hedge against inflation and against bank bail-ins. One video that is making the rounds in the alternative media this week is from ITM Trading, where Taylor Kennedy claims that the "shadow banking" system holds over $250 trillion in risky "assets" like derivatives, which she claims are now 49% of global assets, making bank bail-ins a very real possibility. To understand more about bank bail-ins, here is a Fortune article I used in some of my articles in 2023, but now has apparently been taken down and is only available on Archive.org. Here is another good explanation of bank bail-ins from the Ontrack Financial Group. Also published in 2023 was David Webb's work titled "The Great Taking" which was made into a book and documentary. David Webb has an incredible Bio, and came from a family deeply involved in Freemasonry. He was a successful Wall Street manager for years, and now lives in Switzerland where he owns farmland. He is originally from Cleveland. I would consider Webb a true “whistleblower” who knows the intricacies of Freemasonry and the world’s financial system, through previous experience.