by Brian Shilhavy

Editor, Health Impact News

Note: While I am writing and publishing this article on March 31, 2023, most of you will be reading this on April 1, 2023, or later.

The first week of April, 2023 marks the beginning of the enrollment and certification process for financial institutions to start participating in the Federal Reserve’s new FedNow “Instant Payments” services, which is scheduled to launch in July, 2023. (Source.)

What is FedNow?

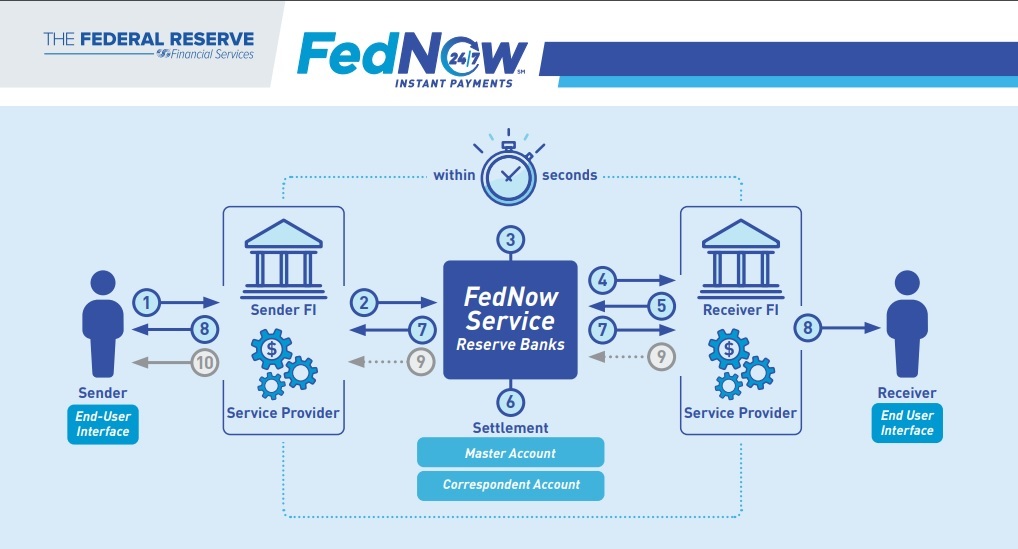

The FedNow Service is a new instant payment infrastructure developed by the Federal Reserve that allows financial institutions of every size across the U.S. to provide safe and efficient instant payment services.

Through financial institutions participating in the FedNow Service, businesses and individuals can send and receive instant payments in real time, around the clock, every day of the year. Financial institutions and their service providers can use the service to provide innovative instant payment services to customers, and recipients will have full access to funds immediately, allowing for greater financial flexibility when making time-sensitive payments.

The FedNow Service will be deployed in phases, with the initial launch taking place July 2023.

The video below follows a payment over the FedNow Service from start to finish, highlighting what financial institutions need to know about their role in the process.

While many in the alternative media (myself included) have linked the FedNow program to Central Bank Digital Currencies (CBDCs), technically speaking, FedNow is NOT part of the development of CBDCs.

Michelle Bateman, Director of Product Management, Payments at Finastra, is a member of FedNow’s pilot program, and she has stated that the project to develop CBDCs is completely separate from the FedNow Instant Payment service.

And what about central bank digital currency (CBDC)? As has been widely reported, the Fed, like most other central banks in developed nations, is investigating the potential of a digital currency or digital dollar.

Bateman noted that it is still being reviewed, and the two projects are completely separate. (Source.)

The main difference is that once CBDCs are rolled out, consumers will have accounts with a Federal Reserve Bank, while the FedNow program does not. The FedNow program will be offering “Master Accounts” at the Federal Reserve for financial institutions only.

However, as I have previously stated, rolling out CBDCs is a mammoth project, and cannot be done overnight. It would be foolish to believe that the FedNow program is not a stepping stone towards CBDCs.

As you can see from the flow chart at the top of this article, with the implementation of the FedNow Instant Transfer program, all the data involving a financial transaction between two “End-Users” will flow through the Federal Reserve banks.

So while they are advertising the FedNow program as a new system that will make payments and wire transfers much quicker and much more convenient, it is also a mass data collection system for the Fed to begin storing private bank information.

Will this include all the personal details of account holders in private banks?

Yes, apparently it does, based on “Operating Circular 1 (OC 1)“, a document on the Federal Reserve website under “Rules and Regulations Resources.”

In that document, Section 6.0 deals with “FEDERAL RESERVE BANK RESPONSE PROGRAM FOR UNAUTHORIZED ACCESS TO SENSITIVE CONSUMER INFORMATION OBTAINED IN THE COURSE OF PROVIDING FINANCIAL SERVICES.”

Section 6.1, “THE RESERVE BANK’S POSSESSION AND USE OF CONSUMER INFORMATION” states:

The Reserve Banks do not hold accounts for individuals and do not provide Reserve Bank services to individuals. In the course of providing Financial Services to Depository Institutions and other authorized users of Reserve Bank services, the Reserve Banks obtain, store, and transmit information that includes Sensitive Consumer Information.

Under the general supervision of the Board of Governors, the Reserve Banks have implemented information security measures designed to protect the security and confidentiality of nonpublic personal information obtained by them, to protect against any anticipated threats or hazards to the security or integrity of such information, and to protect against unauthorized access to or use or reuse of such information that could result in substantial harm or inconvenience to a Depository Institution’s customer.

In other words, the Fed needs all of your “Sensitive” information to protect you from hackers.

What is that “Sensitive Consumer Information”?

Section 6.2 defines that:

Sensitive Consumer Information means a consumer’s name, address or telephone number, in conjunction with the consumer’s social security number, driver’s license number, account number, credit or debit card number, or a personal identification number or password that would permit access to the consumer’s account, if the Reserve Bank or any other party that holds Sensitive Consumer Information as an agent of the Reserve Bank obtains such information in the course of providing Financial Services. (Source.)

How convenient. So when they are ready to roll out CBDCs and establish an account for you, they will already know everything about you and be able to open an account for you at the Federal Reserve, even if you choose not to participate, if your bank was already participating in the FedNow program.

This will save months, if not years, in trying to collect this data in order to implement CBDCs.

It still remains to be seen how many financial institutions decide to participate in FedNow, since it is voluntary. The U.S. Treasury is already part of the program, so if someone wants their tax returns instantaneously, the FedNow service will be very attractive.

Visa and Mastercard are also already part of FedNow. Banks will undoubtedly be pressured to participate for fear of being left out of the advantages of “Instant Payments.”

This appears to be the beginning of the end for “private banking” in the U.S., no fooling.

This article was written by Human Superior Intelligence (HSI)

See Also:

Understand the Times We are Currently Living Through

New FREE eBook! Restoring the Foundation of New Testament Faith in Jesus Christ – by Brian Shilhavy

Who are God’s “Chosen People”?

KABBALAH: The Anti-Christ Religion of Satan that Controls the World Today

Christian Teaching on Sex and Marriage vs. The Actual Biblical Teaching

Exposing the Christian Zionism Cult

The Bewitching of America with the Evil Eye and the Mark of the Beast

Jesus Christ’s Opposition to the Jewish State: Lessons for Today

Identifying the Luciferian Globalists Implementing the New World Order – Who are the “Jews”?

The Brain Myth: Your Intellect and Thoughts Originate in Your Heart, Not Your Brain

What is the Condition of Your Heart? The Superiority of the Human Heart over the Human Brain

The Seal and Mark of God is Far More Important than the “Mark of the Beast” – Are You Prepared for What’s Coming?

The Satanic Roots to Modern Medicine – The Image of the Beast?

Medicine: Idolatry in the Twenty First Century – 10-Year-Old Article More Relevant Today than the Day it was Written

Having problems receiving our emails? See:

How to Beat Internet Censorship and Create Your Own Newsfeed

We Are Now on Telegram. Video channels at Bitchute, and Odysee.

If our website is seized and shut down, find us on Telegram, as well as Bitchute and Odysee for further instructions about where to find us.

If you use the TOR Onion browser, here are the links and corresponding URLs to use in the TOR browser to find us on the Dark Web: Health Impact News, Vaccine Impact, Medical Kidnap, Created4Health, CoconutOil.com.

4 Comments