by Mark Hulbert

Market Watch

Excerpts:

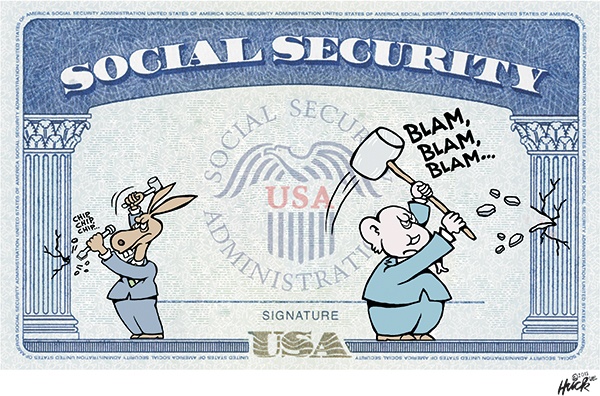

There’s a very real possibility the government will stop issuing Social Security payments after the debt limit is hit.

Scary as that prospect is, however, the alternative might be even worse: A little-known provision of a 1996 law could be interpreted to allow the Social Security trust fund to be used not only to pay Social Security’s monthly checks but also to circumvent the debt limit and pay all the government’s otherwise overdue bills.

If that happens, any short-term relief to Social Security recipients would come with a potentially huge long-term price tag: The Social Security trust fund could be exhausted much sooner than currently projected—in just a couple of years, in fact.

These dire possibilities emerge from an analysis conducted by Steve Robinson, the chief economist for The Concord Coalition, a group that describes itself as “a nonpartisan organization dedicated to educating the public and finding common sense solutions to our nation’s fiscal policy challenges.”

An issue brief he wrote, entitled “Social Security’s Debt Limit Escape Clause,” is available on the group’s website.

Let me hasten to add that Robinson is not advocating that the Social Security trust fund be used in this way. In an interview, he instead stressed that he wrote his issue brief because we need to be aware not only that this “escape clause” exists but that its use could have unintended consequences. Though hardly anyone outside Washington knows that it even exists, and relatively few on Capitol Hill, the Treasury Department and the Social Security Administration are very much aware of it.

The 1996 law that creates the escape clause was passed in the wake of the government hitting its debt limit in 1995 and 1996. Ironically, the intent of that law was to prevent the Social Security trust fund from being used for anything other than paying Social Security benefits. But, Robinson explains, that’s unworkable in the real world. That’s because Social Security checks are sent out by the Treasury’s general account, and if that account is in default the checks would bounce.

If and when the debt limit is hit, therefore, the only way—in practice—for Social Security checks to continue being issued and cleared through the banking system would be for the Social Security trust fund to “lend” the Treasury sufficient funds that it could pay all the government’s unmet obligations.

Therefore, if the debt limit is hit, which it is projected to do perhaps as early as June, Congress and the president will be on the horns of a huge dilemma:

- Do they allow Social Security checks to continue getting paid, risking the political fallout of being accused of “raiding” the Social Security trust fund?

- Or do they stop issuing Social Security payments, risking the political fallout of not issuing Social Security payments, on whom the very livelihoods of many elderly currently depend?

You can appreciate why Congress and the president don’t want us to know that this escape clause exists. Once we are aware of it, they are put in a no-win situation.

Read the full article at Market Watch.

This article was written by Human Superior Intelligence (HSI)

See Also:

Understand the Times We are Currently Living Through

Where is Your Citizenship Registered?

The Bewitching of America with the Evil Eye and the Mark of the Beast

Jesus Christ’s Opposition to the Jewish State: Lessons for Today

Distinguishing True Prophets from False Prophets in These Evil Modern Times

Who Controls the World? by Dr. A. True Ott

Exposing the Christian Zionism Cult

Insider Exposes Freemasonry as the World’s Oldest Secret Religion and the Luciferian Plans for The New World Order

Identifying the Luciferian Globalists Implementing the New World Order – Who are the “Jews”?

The Brain Myth: Your Intellect and Thoughts Originate in Your Heart, Not Your Brain

Fact Check: “Christianity” and the Christian Religion is NOT Found in the Bible – The Person Jesus Christ Is

The Seal and Mark of God is Far More Important than the “Mark of the Beast” – Are You Prepared for What’s Coming?

The Satanic Roots to Modern Medicine – The Mark of the Beast?

Medicine: Idolatry in the Twenty First Century – 8-Year-Old Article More Relevant Today than the Day it was Written

Having problems receiving our emails? See:

How to Beat Internet Censorship and Create Your Own Newsfeed

We Are Now on Telegram. Video channels at Bitchute, and Odysee.

If our website is seized and shut down, find us on Telegram, as well as Bitchute and Odysee for further instructions about where to find us.

If you use the TOR Onion browser, here are the links and corresponding URLs to use in the TOR browser to find us on the Dark Web: Health Impact News, Vaccine Impact, Medical Kidnap, Created4Health, CoconutOil.com.

One Comment