by Brian Shilhavy

Editor, Health Impact News

The Consumer Financial Protection Bureau (CFPB) published a warning to consumers this past week stating that funds held in popular online payment apps, such as Paypal, Cash App, and Venmo, lack FDIC insurance and should be transferred to “insured banks and credit unions.”

CFPB Finds that Billions of Dollars Stored on Popular Payment Apps May Lack Federal Insurance

Agency issues notice to consumers advising them to transfer balances to insured banks and credit unions

WASHINGTON, D.C. – The Consumer Financial Protection Bureau (CFPB) published an issue spotlight on digital payment apps heavily used by consumers and businesses. The analysis finds that funds stored on these apps may not be safe in the event of financial distress, since the funds may not be held in accounts with federal deposit insurance coverage. The CFPB also issued a consumer advisory for customers holding funds in these apps and how they can make sure their funds remain safe.

“Popular digital payment apps are increasingly used as substitutes for a traditional bank or credit union account but lack the same protections to ensure that funds are safe,” said CFPB Director Rohit Chopra. “As tech companies expand into banking and payments, the CFPB is sharpening its focus on those that sidestep the safeguards that local banks and credit unions have long adhered to.”

Use of nonbank payment apps such as PayPal, Venmo, and Cash App have rapidly grown in the past few years. These apps allow people to quickly pay retailers and others, while providing the option to store funds. Unlike traditional bank and credit union accounts which have deposit insurance, funds stored in these nonbank payment companies may be unprotected.

In recent months, many Americans were reminded that funds deposited with banks and credit unions enjoy the safety afforded by federal deposit insurance through the FDIC or NCUA.

Americans witnessed the failure of large systemically important banks such as Silicon Valley Bank, Signature Bank, and First Republic Bank. These banks experienced a run, but insured depositors could have confidence their money was safe. However, similar protection would not be guaranteed to customers that store money on nonbank payment apps. (Source.)

What is the “Consumer Financial Protection Bureau“? Why are they issuing this warning, which could obviously have a serious negative impact on these payment apps if many consumers take their advice and start withdrawing their funds from them?

The “About Us” page on their website, which at the bottom of every page in their footer says: “An official website of the United States government“, doesn’t give much information about who they are:

The Consumer Financial Protection Bureau is a 21st century agency that implements and enforces Federal consumer financial law and ensures that markets for consumer financial products are fair, transparent, and competitive. (Source.)

Whenever a website, especially one that claims to be “An official website of the United States government”, does not give much information on their “About Us” page, the next thing to check is: who are the people running this organization?

Rohit Chopra is the director.

Rohit Chopra is Director of the Consumer Financial Protection Bureau. The CFPB is a unit of the Federal Reserve System charged with protecting families and honest businesses from illegal practices by financial institutions, and ensuring that markets for consumer financial products and services are fair, transparent, and competitive.

As Director, Chopra is also a member of the Board of Directors of the Federal Deposit Insurance Corporation and the Financial Stability Oversight Council. (Source.)

Bingo! So the CFPB is a “unit” of the U.S. Federal Reserve Central Banking System.

This “unit” was created in 2010 under the Obama Administration, and according to their history on Wikipedia, it has been involved in controversy since its inception.

The CFPB’s creation was authorized by the Dodd–Frank Wall Street Reform and Consumer Protection Act, whose passage in 2010 was a legislative response to the financial crisis of 2007–08 and the subsequent Great Recession and is an independent bureau within the Federal Reserve.

The CFPB’s status as an independent agency has been subject to many challenges in court. In June 2020, the United States Supreme Court found the single-director structure removable only with-cause unconstitutional but allowed the agency to remain in operation.

On September 17, 2010, President Obama announced the appointment of Warren as Assistant to the President and Special Advisor to the Secretary of the Treasury on the Consumer Financial Protection Bureau to set up the new agency.

Due to the way the legislation creating the bureau was written, until the first Director was in place, the agency was not able to write new rules or supervise financial institutions other than banks.

On July 21, 2011, Senator Richard Shelby wrote an op‑ed for The Wall Street Journal affirming his continued opposition to a centralized structure, noting that both the Securities Exchange Commission and Federal Deposit Insurance Corporation had executive boards and that the CFPB should be no different. He noted lessons learned from experiences with Fannie Mae and Freddie Mac as support for his argument.

Politico interpreted Shelby’s statements as saying that Cordray’s nomination was “dead on arrival”. Republican threats of a filibuster to block the nomination in December 2011 led to Senate inaction.

President Barack Obama announced the nomination of Richard Cordray as the first director of the CFPB on July 18, 2011.

Elizabeth Warren, who proposed and established the CFPB, was removed from consideration as the bureau’s first formal director after Obama administration officials became convinced Warren could not overcome strong Republican opposition.

On July 17, President Obama nominated former Ohio Attorney General and Ohio State Treasurer Richard Cordray to be the first formal director of the CFPB. Prior to his nomination, Cordray had been hired as chief of enforcement for the agency.

However, Cordray’s nomination was immediately in jeopardy due to 44 Senate Republicans vowing to derail any nominee in order to encourage a decentralized structure of the organization. Senate Republicans had also shown a pattern of refusing to consider regulatory agency nominees. The CFPB formally began operation on July 21, 2011.

Since the CFPB database was established in 2011, more than 730,000 complaints have been published. CFPB supporters include the Consumers Union claim that it is a “vital tool that can help consumers make informed decisions”.

CFPB detractors argue that the CFPB database is a “gotcha game” and that there is already a database maintained by the Federal Trade Commission although that information is not available to the public.

On January 4, 2012, Barack Obama issued a recess appointment to install Cordray as director through the end of 2013.

This was a highly controversial move as the Senate was still holding pro forma sessions, and the possibility existed that the appointment could be challenged in court.

This type of recess appointment was unanimously ruled unconstitutional in NLRB v. Noel Canning.

On July 16, 2013, the Senate confirmed Cordray as director in a 66–34 vote. Cordray resigned in late 2017 to run for governor of Ohio.

The Financial CHOICE Act, proposed by the House Financial Services Committee’s Jeb Hensarling, to repeal the Dodd–Frank Wall Street Reform and Consumer Protection Act, passed the House on June 8, 2017. Also in June 2017, the Senate was crafting its own reform bill.

Testimony in US Congressional hearings of 2017 have elicited concerns that the wholesale publication of consumer complaints is both misleading and injurious to the consumer market.

Rep. Barry Loudermilk (R-GA) said at one such congressional hearing, “Is the purpose of the database just to name and shame companies? Or should they have a disclaimer on there that says it’s a fact-free zone, or this is fake news? That’s really what I see happening here.”

Bill Himpler, executive vice president of the American Financial Services Association, a trade group representing banks and other lenders responded “Something needs to be done.” “Once the damage is done to a company, it’s hard to get your reputation back.”

Mick Mulvaney, as acting director of the CFPB, removed all 25 members of the agency’s Consumer Advisory Board on June 5, 2018, after eleven of them held a press conference on June 3 in which they criticized him. (Editor’s Note: This was under the Trump Administration.)

On February 13, 2021, President Joe Biden formally submitted to the Senate the nomination of Rohit Chopra to serve as director of the CFPB. His nomination was approved on September 30, 2021, by a 50-48 vote.

On October 20th, 2022 The Fifth Circuit Court of Appeals struck down the CFPB’s payday lending rule on the grounds that the funds used to draft the bill were unconstitutionally obtained. This court ruling only impacts the 5th circuit. (Full article.)

So what can we learn from this warning published on this “official website of the United States government” which is actually a unit of the Federal Reserve Central Banking System?

First, it is obvious that they are expecting more bank failures. As I have previously reported, the Biden Administration is no longer stating that the U.S. Banking system is “safe and sound.”

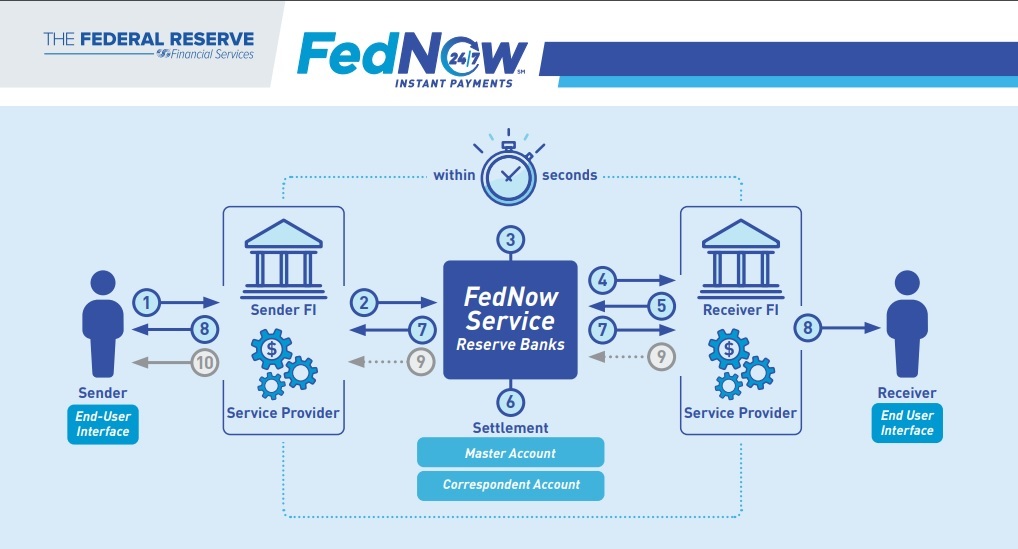

Secondly, as I reported back in April, the Federal Reserve’s new FedNow “Instant Payments” service is scheduled to launch in July, just a few weeks away now. See:

No Fooling: The End of “Private Banking” Starts Today with Bank Enrollments in the New FedNow Program

Banks and other financial institutions have been enrolling in the new FedNow system since April 1st this year (2023).

Could it be that these particular payment apps have not enrolled in FedNow, or that FedNow will introduce their own “payment app” soon that could replace these existing apps?

I am quite certain that at the highest levels of the Federal Reserve discussions are already taking place to prepare for the coming banking collapse, and that they are already deciding which banks will survive, and which ones will not.

As I have previously reported, banking giant Goldman Sachs has already made a move to start dominating online payment apps last April, shortly after the FedNow enrollment process started, by partnering with Apple to use the Apple ID to process online banking services with a high yield savings accounts. See:

Apple Turns iPhone into Ultimate Tracking Tool by Offering Banking Services – AppleID to Become National Digital ID?

120 million Americans own Apple iPhones, and as soon as this new deal with Goldman Sachs was announced, almost $1 billion was moved into this new Goldman Sachs account via Apple iPhone users. (Source.)

This also coincides with Apple gaining dozens of new patents in recent weeks for biometric scanning of finger prints, palms, faces, and irises from your eye. See:

It seems pretty plain to me where all of this is going.

That said, it has NEVER been a good idea to carry large cash balances in these payment apps, especially Paypal, so whatever the motive was to issue this warning this past week, it is actually good advice to get your funds out of those payment apps if you are carrying large cash balances there.

The Fed is basically warning you ahead of time that you are going to lose that money if you keep it there.

This article was written by Human Superior Intelligence (HSI)

See Also:

Understand the Times We are Currently Living Through

New FREE eBook! Restoring the Foundation of New Testament Faith in Jesus Christ – by Brian Shilhavy

Who are God’s “Chosen People”?

KABBALAH: The Anti-Christ Religion of Satan that Controls the World Today

Christian Teaching on Sex and Marriage vs. The Actual Biblical Teaching

Exposing the Christian Zionism Cult

The Bewitching of America with the Evil Eye and the Mark of the Beast

Jesus Christ’s Opposition to the Jewish State: Lessons for Today

Identifying the Luciferian Globalists Implementing the New World Order – Who are the “Jews”?

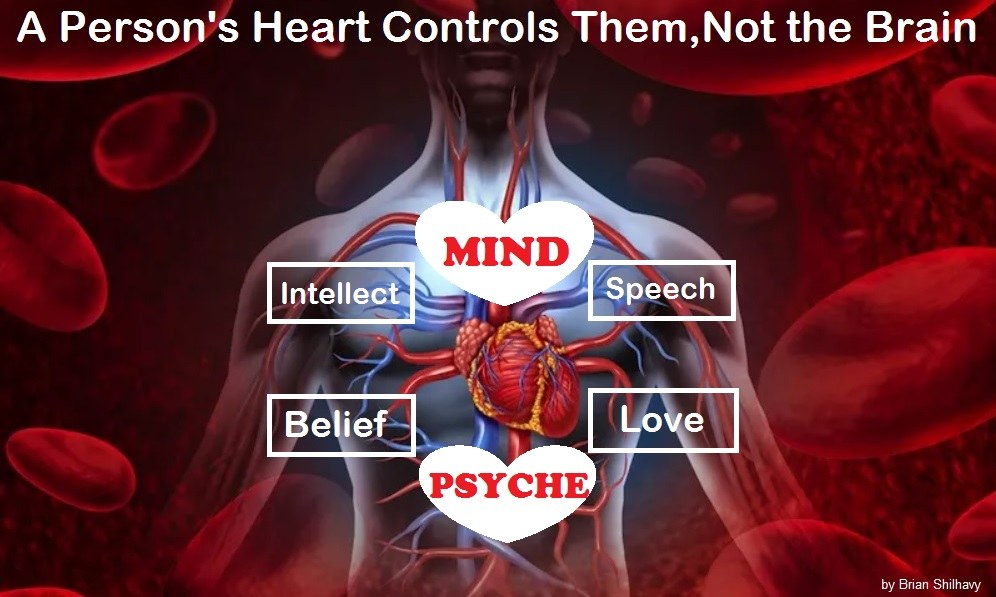

The Brain Myth: Your Intellect and Thoughts Originate in Your Heart, Not Your Brain

What is the Condition of Your Heart? The Superiority of the Human Heart over the Human Brain

The Seal and Mark of God is Far More Important than the “Mark of the Beast” – Are You Prepared for What’s Coming?

The Satanic Roots to Modern Medicine – The Image of the Beast?

Medicine: Idolatry in the Twenty First Century – 10-Year-Old Article More Relevant Today than the Day it was Written

Having problems receiving our emails? See:

How to Beat Internet Censorship and Create Your Own Newsfeed

We Are Now on Telegram. Video channels at Bitchute, and Odysee.

If our website is seized and shut down, find us on Telegram, as well as Bitchute and Odysee for further instructions about where to find us.

If you use the TOR Onion browser, here are the links and corresponding URLs to use in the TOR browser to find us on the Dark Web: Health Impact News, Vaccine Impact, Medical Kidnap, Created4Health, CoconutOil.com.

Join the Discussion