by Brian Shilhavy

Editor, Health Impact News

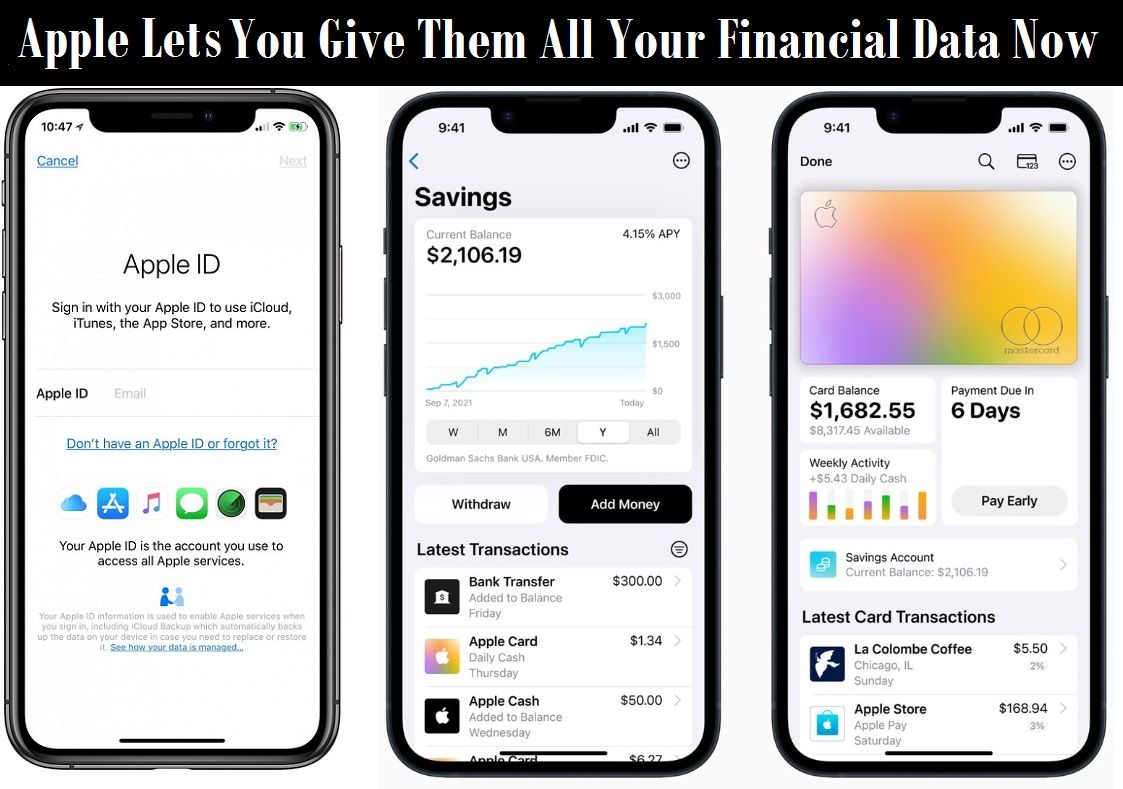

Who needs CBDCs or a National Digital ID program to track every financial transaction you make, when Apple has already beat everyone to the punch with their AppleID that now can be linked to your bank account as well?

Yesterday, Apple announced that they are now offering attractive rates on savings accounts through their Apple Wallet, as they team up with banking giant Goldman Sachs.

With Elon Musk and others racing to create the first “do everything” app that can track pretty much everything one does in life, Apple just beat everyone to the punch by effectively making the iPhone, which is already in the hands of over 120 million people in the U.S., and over 1 billion worldwide, a device that can now pretty much link everything you do to your AppleID.

Apple is now paying you to have an iPhone!

That’s right. Sign up for the savings account now available through Apple Wallet, administered by Goldman Sachs, and you will get an interest rate of 4.15%, Apple announced today.

That’s a very good rate—most other digital-only banks aren’t offering terms quite as generous (as for big banks, forget it—their savings rates are still in the 0.01% ballpark).

Even Goldman Sachs, which actually operates the account, offers only 3.9% on its own Marcus savings accounts right now. Apple is presumably subsidizing that generous rate given that the account is for users of Apple cards, which means it’s designed mainly for iPhones and iPads.

It’s a smart way to entrench the iPhone even more deeply into people’s lives—smart for Apple, that is.

Whether this is smart for consumers depends on whether you’re comfortable having your life ruined if someone steals your iPhone.

The Wall Street Journal recently published an excellent report about how iPhone thieves are draining people’s bank accounts. That’s a result of people storing credit cards on Apple Pay and very often keeping photos of sensitive personal documents—passports and drivers’ licenses, for example—on their phones.

Some people even write down their passwords in the Notes app on the phone. When you stop to think about it, storing all this stuff on a phone does seem kind of crazy. (Full article – Subscription needed.)

This is a brilliant move by Goldman Sachs, which like all U.S. banks right now, is seeing a mass exodus of deposits since the banking crisis started last month.

In their first quarter report today, Goldman Sachs CEO David Solomon admitted that this partnership with Apple will increase bank deposits for their troubled bank.

Asked about Goldman’s new savings account with 4.15% interest for Apple Inc.’s Apple Card customers, Solomon said the business will open up Goldman’s deposit base without much overlap with its existing savings-account customer base. (Source.)

iPhone Users are Now Muppets

Pam Martens of Wall Street on Parade also covered this new venture today, reminding everyone how Goldman Sachs is part of the criminal banking cartel with their history of “dubious dealings” going all the way back to the Wall Street financial crash of 1929.

Apple Is Loaning Its Brand to the Great Vampire Squid to Offer FDIC-Insured Savings Accounts

Apple, maker of the iPhone and one of the top brands in the world, has decided to get deeper in bed with Goldman Sachs, a Wall Street trading house with more than 100 years of ignominious history.

Goldman Sachs was infamously branded as “a great vampire squid wrapped around the face of humanity, relentlessly jamming its blood funnel into anything that smells like money” by Matt Taibbi in the pages of Rolling Stone.

Of all things to offer through Goldman Sachs, Apple thinks it’s a swell idea to offer a high-yielding, FDIC-insured savings account – that is ultimately backstopped by the U.S. taxpayer if Goldman Sachs blows up – which it came close to doing in 2008.

Apple’s credit card is already offered through Goldman Sachs.

In an SEC filing on February 24, Goldman Sachs acknowledged that its credit card division is under federal investigation. A check at the complaint database of the Consumer Financial Protection Bureau (CFPB), a federal agency, shows that hundreds of consumer complaints have been filed against the Goldman Sachs/Apple credit card.

Among the hundreds of complaints filed at the CFPB is the following from a resident of Nevada. The complaint was filed on February 8 of this year: (Redacted material was done by the CFPB.)

“Late last year, Apple credit card pulled a hard inquiry on my credit and issued me an Apple credit card.

I did not request this credit card, so I contacted XXXX about this matter. Apple credit card closed my account and stated to me that they noted my account was closed because they could not verify that I requested, authorized, or applied for this credit card.

I believe this credit card was requested by an XXXX store agent, without my authorization, when I purchased a new iphone. I believe this because the agent signed me up for several other offers that I did not request.

These matters have been resolved with XXXX. Regarding the hard inquiry, the XXXX representative told me to contact each credit reporting agency to request that the hard inquiry be removed from my credit report.

XXXX will be reporting this account as closed due to unable to verify that I applied for the credit card. Thank you for assisting in the removal of the hard inquiry with each agency.”

In announcing the new savings account venture with Goldman Sachs yesterday, Apple provided the following information:

“Once a Savings account is set up, all future Daily Cash earned by the user will be automatically deposited into the account. The Daily Cash destination can also be changed at any time, and there’s no limit on how much Daily Cash users can earn.

To build on their savings even further, users can deposit additional funds into their Savings account through a linked bank account, or from their Apple Cash balance.” [Bold emphasis added by Wall Street On Parade.]

Linking one’s primary bank account to anything connected to Goldman Sachs should be very carefully considered. Goldman Sachs is a global bank and has been a target of hackers in the past. (See here and here, for example.)

Complaints filed at the CFPB about the Apple/Goldman Sachs credit card include complaints regarding hacking. On January 13 of this year, the following hacking complaint was filed by a resident of California:

“I signed up for an Apple Card, and then my Apple account got hacked. I started getting charges on my Apple Card, and got billed statements by mail, but none of the charges were made by me.

I’ve made numerous attempts to contact Apple, but they keep telling me to try to log into my account to fix the issue. I can not get into my card because it got hacked and the phone number connected to it has been changed by the hacker as well.

They can not help me get into my account AND they can not stop the charges. My credit line on that card is also only {$12,000.00}, but somehow this hacker his racked up charges upwards of {$30,000.00} when this shouldn’t be even possible?

Not a single transaction was from me, and I can not stop them. This is affecting my well being and also my credit score. I desperately need help to stop them and fix this situation. Please help me.”

Dubious dealings at Goldman Sachs go all the way back to the leadup to the Wall Street financial crash of 1929. During the asset bubble of 1928, Goldman ran the Goldman Sachs Trading Company, a closed end fund (called a trust in those days) that Goldman Sachs created and offered to the public at $104 a share.

The trust was filled with conflicted investments while paying Goldman a hefty management fee. Within a few years after the crash, the Goldman Sachs trust was trading at a buck and change.

On May 20, 1932, Walter Sachs, President of the Goldman Sachs Trading Company, was interrogated by the Senate Committee on Banking and Currency. The Committee concluded that Goldman Sachs fleeced its customers to line its own pockets.

On April 27, 2010 the U.S. Senate’s Permanent Subcommittee on Investigations held a hearing and interviewed multiple executives of Goldman Sachs over its role in the subprime crisis.

Goldman Sachs also has the distinction of being the only Wall Street firm to have an executive submit his resignation via the OpEd page of the New York Times.

On March 14, 2012, Greg Smith, a 12-year veteran of Goldman Sachs and a Vice President, explained why he was resigning, writing in part: “…how callously people talk about ripping their clients off. Over the last 12 months I have seen five different managing directors refer to their own clients as ‘muppets.’ ”

The muppets’ reference went viral as internet memes, including law professor and former Wall Street veteran Frank Partnoy reworking the lyrics of Bret McKenzie’s song, “Man or Muppet.”

Good luck, Apple, with your co-branding idea from hell.

Read the full article at Wall Street on Parade.

Big Tech’s Alliance with the Government Shows a National Digital ID System is Probably Already in Place and Can be Implemented Soon

Last month (March, 2023) we reported how there is widespread push back now against Central Bank Digital Currencies (CBDCs), and that the Republican party has now made this a political issue. See:

Central Bank Digital Currency Fail? Worldwide Resistance Against Central Banks Gains Momentum

Since it will take time, perhaps years, to actually implement CBDCs, I am becoming more convinced than ever that the whole CBDC scare is a distraction.

Because the fact is that most Americans today already volunteer most of their personal data, including banking info, by consenting to use Big Tech’s products.

With these attractive savings account rates that Apple is now offering to those with an AppleID, how many people do you think will now avail of this new service by Apple and Goldman Sachs?

I would guess tens of millions of people will, from the 120 million+ iPhone users in the U.S.

And this is in addition to the hundreds of other banking apps that are already out there that users of cell phones can download and start using, although I suspect that most of these banks are on the path to failure, and that in the end we will end up with only a handful of banks that survive, which will make digital use and compliance even easier.

The data and the system to implement a national digital ID are already in place, without the use of CBDCs. Everyone reading this in the U.S. already has probably at least two government IDs: your social security number, and a driver’s license. Some also have a national passport for international travel.

How long before these databases are merged together with digital IDs that already exist, such as the AppleID?

Microsoft also has a database of digital IDs, as does the TSA for traveling, for example, and there are many others as well.

And as we previously reported, starting this summer most banks in the U.S. will start participating in the FedNow instant payment program, giving the Federal Reserve access to your bank account. See:

No Fooling: The End of “Private Banking” Starts Today with Bank Enrollments in the New FedNow Program

Resistance is NOT Futile

So what’s the solution?

RESIST!

If enough people resist the takeover of our private lives by Big Tech and the U.S. Government, new market opportunities will open. There are already merchants who cater to the privacy market, but that market is still too small, as most people just willingly trade away their privacy for convenience.

There are companies, for example, that sell “de-Googled” phones with a stripped down version of Android. But it is still a small market, and even if you have a device like one of these, you still have to be willing to give up some of your “digital comfort” by not downloading apps from Google which will defeat the purpose of even having such a device.

There are alternative app suppositories that bypass the Google and Apple app stores, but they are still small because not that many people use them.

In the end, it really is not that difficult to beat Big Tech. You just have to stop using their products. I am old enough to remember what life was like without this technology that connected everyone to the Internet, and we survived just fine.

If enough people resist the takeover of our private lives by Big Tech and the Government, a lot of the “old technology” could make a comeback – like older vehicles that still take you where you want to go, but are not connected to the Internet so that your vehicle tracks everywhere you go and everything you do with that vehicle. See:

Is Your Car Recording You? Tesla Employees Admit to Sharing Photos and Videos of Owners Including “Intimacy”, Kids, and Location

So if you don’t want to be reduced to a “muppet” where your life is attached to those who want to control you, ditch the iPhone!!

This article was written by Human Superior Intelligence (HSI)

See Also:

Understand the Times We are Currently Living Through

New FREE eBook! Restoring the Foundation of New Testament Faith in Jesus Christ – by Brian Shilhavy

Who are God’s “Chosen People”?

KABBALAH: The Anti-Christ Religion of Satan that Controls the World Today

Christian Teaching on Sex and Marriage vs. The Actual Biblical Teaching

Exposing the Christian Zionism Cult

The Bewitching of America with the Evil Eye and the Mark of the Beast

Jesus Christ’s Opposition to the Jewish State: Lessons for Today

Identifying the Luciferian Globalists Implementing the New World Order – Who are the “Jews”?

The Brain Myth: Your Intellect and Thoughts Originate in Your Heart, Not Your Brain

What is the Condition of Your Heart? The Superiority of the Human Heart over the Human Brain

The Seal and Mark of God is Far More Important than the “Mark of the Beast” – Are You Prepared for What’s Coming?

The Satanic Roots to Modern Medicine – The Image of the Beast?

Medicine: Idolatry in the Twenty First Century – 10-Year-Old Article More Relevant Today than the Day it was Written

Having problems receiving our emails? See:

How to Beat Internet Censorship and Create Your Own Newsfeed

We Are Now on Telegram. Video channels at Bitchute, and Odysee.

If our website is seized and shut down, find us on Telegram, as well as Bitchute and Odysee for further instructions about where to find us.

If you use the TOR Onion browser, here are the links and corresponding URLs to use in the TOR browser to find us on the Dark Web: Health Impact News, Vaccine Impact, Medical Kidnap, Created4Health, CoconutOil.com.

2 Comments