by Brian Shilhavy

Editor, Health Impact News

With the collapse yesterday of the world’s first SIFI (systemically important financial institution – “too big to fail”) bank, Credit Suisse, the reality that the financial system of western culture is now on the brink of collapse is starting to sink in with Americans.

While still not headline news in the American corporate media, financial headlines were notably pessimistic today, even with the stock market posting gains.

The more dire outlooks are still being published as “opinion pieces,” but it appears that more and more Americans are starting to face the reality that life as we have known it, is about to radically change.

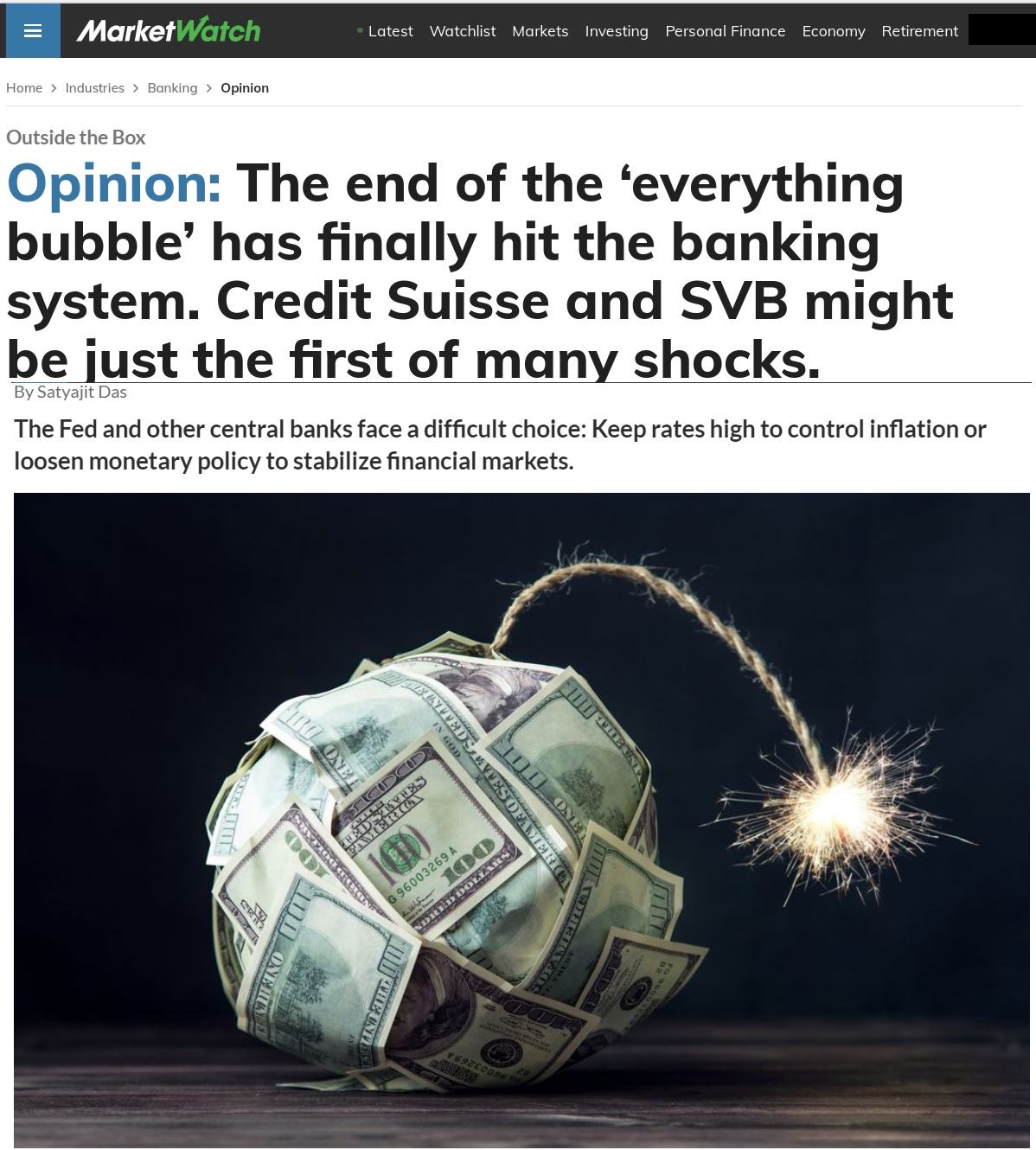

Here is an article that was featured on the Home Page of Market Watch for most of the day today, while the markets were open. And while it is listed as an “opinion” piece, it sure reads like a news article to me.

Opinion: The end of the ‘everything bubble’ has finally hit the banking system. Credit Suisse and SVB might be just the first of many shocks.

The Fed and other central banks face a difficult choice: Keep rates high to control inflation or loosen monetary policy to stabilize financial markets.

by Satyajit Das

Market Watch

Excerpts:

Major financial market regime changes typically take place in stages. The crypto meltdown in 2022, for example, incurred about $2 trillion of losses. The technology meltdown followed, with losses of about $5 trillion, the U.K. government bond (gilt) crisis ($500 billion in losses), plus an ongoing emerging market debt crisis.

These problems have now reached the world’s financial system, with U.S., European and Japanese banks losing around $460 billion in market value so far in March alone.

The immediate cause is the rapid increase in official interest rates in the U.S. and other major global economies. The true cause is the unwinding of an economic and financial structure built upon an artificially low cost of money, which gave rise to the “everything bubble” and its leveraged speculation.

The banking system’s problems may not be over. The collapse of Silicon Valley Bank SIVB, highlighted the interest-rate risk of purchasing long-term securities financed with short-term deposits and the susceptibility to a liquidity run. Banks globally face falling customer deposits (projected to decline in the U.S. by up to 6%) and losses on holding of securities ( (unrealized losses at FDIC insured U.S. banks exceed $600 billion at end of 2022). A 10% loss on bank bond holdings would, if realized, decrease bank shareholder capital by around 25%.

When other interest-sensitive assets are included, one estimate puts the loss for U.S. banks alone at $2 trillion. Globally, the total unrealized loss might be two to three times that. The fact is that higher rates and losses on securities have significantly weakened the global banking system. (Full article. Subscription required.)

The independent financial alternative media, without needing investors and editors’ approval to print anything, was much more apocalyptic. Here are a few headlines from ZeroHedge News today:

The Banking System is On The Brink of Collapse

This Financial Crisis Will Be Like None Other In History

“Nowhere To Hide In CMBS”: CRE Nuke Goes Off With Small Banks Accounting For 70% Of Commercial Real Estate Loans

A New World Order is Emerging, and it is NOT Led by the Davos Crowd and the World Economic Forum

It is ironic, or perhaps even prophetic, that the first “too big to fail” bank to collapse was from the banking industry out of Switzerland, with the entire Swiss economy now on the brink of collapse.

For centuries now, Swiss banks have held the deposits of some of the wealthiest people on earth, as well as some of the most notorious criminal cartels, often providing a tax shelter from deposits in U.S. or other European banks.

Switzerland, of course, is also home to the World Economic Forum, part of the United Nations.

And while every major country usually attends the meetings at the World Economic Forum, it is run by western nations, mainly the United States and NATO members.

This is who I am referring to as the “Davos Crowd.”

It includes the Bank of International Settlements (BIS), which is closely related to The World Bank, and the International Monetary Fund (IMF), which are both located in Washington D.C.

The “Davos Crowd” is dominated by the two most powerful families in Western Culture, the Rothschilds in Europe, and the Rockefellers in the United States.

They are the ones who created the U.S. Federal Reserve, which is quickly losing its influence as the most powerful financial entity in the world.

Historically, this “Davos Crowd” has been controlled by eight families. See:

The Federal Reserve Cartel – Eight Families own the USA, BIS, IMF, World Bank

But as the wealth of these family dynasties is now quickly evaporating away, and as their banking system collapses, new leaders are emerging to oppose the Davos Crowd, led by four countries that are leading the rest of the non-western world today: China, Russia, Saudi Arabia, and Iran.

The collapse of the banking system of the Davos Crowd will most certainly have negative repercussions for these four countries and the rest of the world as well, but they might be poised to emerge from the crisis much more quickly, and they are very rapidly forming alliances to hasten that recovery.

As I write this, Chinese leader Xi Jinping is in Moscow holding talks with Russian President Vladimir Putin, in open defiance of the Davos Crowd’s International Criminal Court’s recently issued arrest warrant for President Putin for “war crimes in Ukraine.”

Chinese leader Xi Jinping arrived in Moscow on Monday for three days of talks with Russian President Vladimir Putin, a visit eyed warily by the U.S. and Western allies.

Xi’s first visit since Russia invaded Ukraine would appear to show support for Putin, who needs trade deals and bullets as he faces pressure from economic sanctions and reports that his military is running low on ammunition and fighting equipment.

“It gives me great pleasure to once again set foot on the soil of Russia, our friendly neighbor,” said Xi, who added that he first visited as president 10 years ago.

China has called for a cease-fire and peace talks, a plan praised by Moscow but rejected by Kyiv because it would keep Russian troops in occupied territory.

“We will discuss … your initiative that we highly respect,” Putin said after the leaders shook hands. “Our cooperation in the international arena undoubtedly helps strengthen the basic principles of the global order and multipolarity.”

The trip comes days after the International Criminal Court issued an arrest warrant for Putin, accusing him of war crimes in Ukraine. (Source.)

While the United States is just at the beginning of a financial crisis, Russia has already had more than a year of financial hardships as the result of sanctions and being cut off from western banks via the SWIFT (Society for Worldwide Interbank Financial Telecommunications) system.

This has forced Russia to develop new markets for its exports, as well as a new banking system for international transfers. And there are signs that they are already on the road to economic recovery, as it was reported today that exports of Russian oil to China have increased 23.8% since last year. See:

Russia Overtakes Saudi Arabia To Become China’s Top Oil Supplier

China also shows signs of an economic recovery after their self-inflicted economic collapse that resulted from their Zero COVID policy and lockdowns in most of the major cities in China last year.

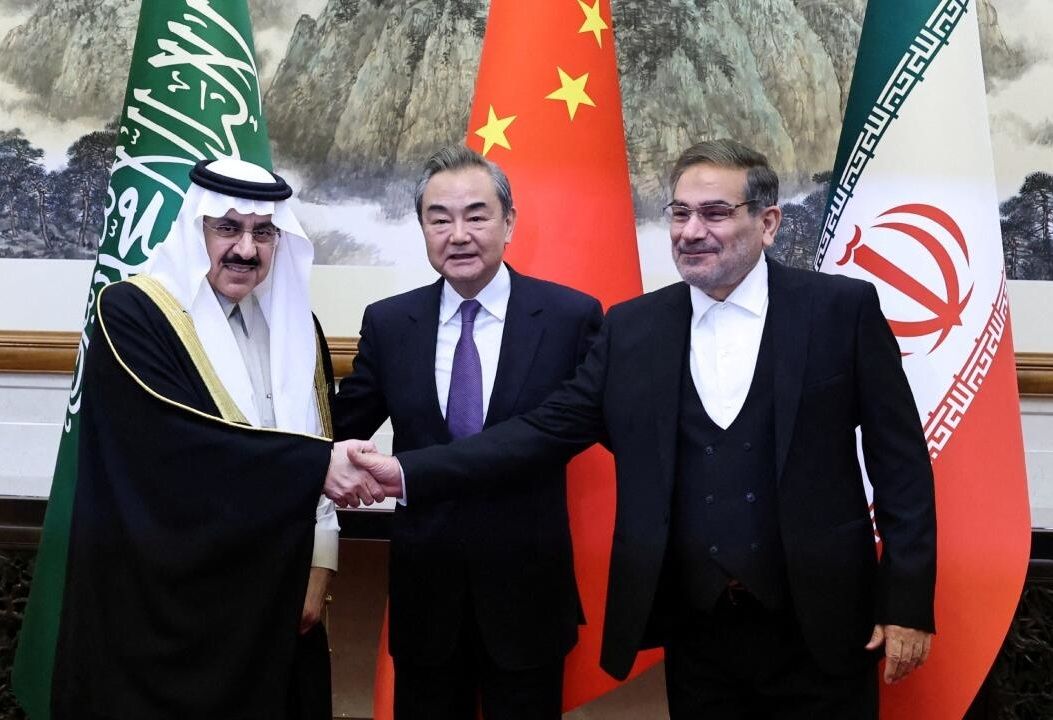

Ali Shamkhani, the secretary of Iran’s Supreme National Security Council, Wang Yi, a member of the Political Bureau of the Communist Party of China (CPC) Central Committee and director of the Office of the Central Foreign Affairs Commission, Minister of State and national security adviser of Saudi Arabia Musaad bin Mohammed Al Aiban. Image source.

The most significant geo-political event this month (March, 2023), however, is what took place in Beijing, China, on March 10th.

The significance of Saudi Arabia and Iran, who have been bitter enemies for most of their history, in deciding to put aside their differences and start working together, is so incredible, that it would need an entire separate article to fully explain.

I can say this not only from reading various sources, but having lived in Saudi Arabia for several years where I worked as an English professor at King Fahd University of Petroleum and Minerals in Dhahran back in the early 1990s.

This is not only a potential alliance of major world producers of oil, but it is potentially an event that will end many wars in the Middle East between Sunni and Shi’a Muslims, such as in Syria and Yemen.

An alliance between Saudi Arabia and Iran, which has been brokered by China, can potentially not only bring peace to the Middle East, it can also end the United States’ world dominance in oil, and spell doom for the U.S. dollar, or the “petrodollar.”

Once you grasp the significance of this alliance, it will make perfect sense why President Joe Biden, facing the risk of potentially losing petroleum imports from Saudi Arabia in the future, recently reversed his own position and risked the scorn of his own party by agreeing to approve ConocoPhillips’ $7 billion oil and gas drilling Willow project in Alaska’s National Petroleum Reserve. (Source.)

The problems between the U.S. and Saudi Arabia have been brewing for years, especially since the rise of the Saudi populist leader, Mohammed bin Salman Al Saud (MBS).

Sam Parker, himself a Muslim and obviously using a pen name for his writings, has recently written a comprehensive analysis of MBS and his opposition to the U.S. at Behind The News Network.

It is a long piece, but well worth reading, and I will end this article today with some excerpts from Parker’s analysis. And one thing to keep in mind as you read this, it was written a few months ago, BEFORE this alliance between Saudi Arabia and Iran.

The Arab states were only ever partners, not allies to the US, and had no fundamental loyalty beyond the factor of who could provide their states with the most benefits, turning a blind eye to decades of US-led wars and destruction across the region.

Now, the rise of China has signaled a new source of wealth, opportunity, and security for the Arab World, leading them to hedge their bets.

Saudi Arabia was the largest oil exporter, while the US was the world’s largest oil importer. Over the past 2 decades, the US began to reduce its imports of Saudi oil.

While, in the past 2 decades, China has become the world’s largest oil importer- AND, Saudi Arabia is still the world’s largest oil exporter, as well as China’s oil supplier. So, these blossoming energy-economic ties can only strengthen in the future.

There have been HINTS in the media from Saudi officials about the need to sell its energy for currencies besides the dollar, whether it be the yuan, the rupee, or any other currency of its major trading partners.

But, it is only a hint for the moment. MBS (in conjunction with Putin) is increasing the pressure on the Rockefeller Empire.

Were MBS to implement this new oil sale policy by selling energy for other currencies, then the Rockefeller Empire will unleash all its dogs to kill MBS and destabilize Saudi Arabia.

In this scenario, one can expect both the US and Israel will try hard to create more conflict between Iran and Saudi Arabia. It is for this reason; MBS and Iran are becoming closer.

Were a peace deal to happen between Saudi Arabia and Iran, it would remove any possibility for the 2 families to ignite war in the region; their policy of “divide-and-rule” will no more work. It will also provide a reason for the eviction of US military forces from the region. And, there goes Israel.

Ever since the start of Ukraine’s military conflict in February 2022, we have essentially been watching the western-led financial industry waging its war against the eastern-dominated energy economy.

The momentum will always be with the latter, because as stated above, in contrast to money, energy cannot be printed.

The oil and gas volumes needed to replace Russian energy sources cannot be found on the world market within a year. And no commodity is more global than oil.

Any changes in the oil market will always influence the world’s economy.

“Oil makes and breaks nations.” The late former Saudi oil minister Zaki Yamani once described oil alliances as being stronger than Catholic marriages. If that is the case, then the old US-Saudi marriage is currently undergoing estrangement and Russia has filed for divorce from Europe.

A final point to note is that the petro-dollar had a violent birth. Its demise will be even more violent and destructive. (Emphasis mine, read the full article here.)

This article was written by Human Superior Intelligence (HSI)

See Also:

Understand the Times We are Currently Living Through

Where is Your Citizenship Registered?

The Bewitching of America with the Evil Eye and the Mark of the Beast

Jesus Christ’s Opposition to the Jewish State: Lessons for Today

Distinguishing True Prophets from False Prophets in These Evil Modern Times

Who Controls the World? by Dr. A. True Ott

Exposing the Christian Zionism Cult

Insider Exposes Freemasonry as the World’s Oldest Secret Religion and the Luciferian Plans for The New World Order

Identifying the Luciferian Globalists Implementing the New World Order – Who are the “Jews”?

The Brain Myth: Your Intellect and Thoughts Originate in Your Heart, Not Your Brain

Fact Check: “Christianity” and the Christian Religion is NOT Found in the Bible – The Person Jesus Christ Is

The Seal and Mark of God is Far More Important than the “Mark of the Beast” – Are You Prepared for What’s Coming?

The Satanic Roots to Modern Medicine – The Mark of the Beast?

Medicine: Idolatry in the Twenty First Century – 8-Year-Old Article More Relevant Today than the Day it was Written

Having problems receiving our emails? See:

How to Beat Internet Censorship and Create Your Own Newsfeed

We Are Now on Telegram. Video channels at Bitchute, and Odysee.

If our website is seized and shut down, find us on Telegram, as well as Bitchute and Odysee for further instructions about where to find us.

If you use the TOR Onion browser, here are the links and corresponding URLs to use in the TOR browser to find us on the Dark Web: Health Impact News, Vaccine Impact, Medical Kidnap, Created4Health, CoconutOil.com.

2 Comments