by Brian Shilhavy

Editor, Health Impact News

Silicon Valley Bank became the second FDIC-insured bank to collapse in 3 days today. They are reportedly the 16th largest bank in the U.S., and the largest bank to collapse since the 2008 financial meltdown, and the second largest bank to ever collapse in the U.S.

While it was still not the main headline news this morning in the corporate media, a glance at the headlines as I began to write this article shows that it is apparently now getting the headline news it should receive, as bank runs are starting, and some banks suspended trading today to stop the carnage.

The Alternative Media is mostly still asleep, ranting and raving about new “Jan. 6 footage” and the Tucker Carlson show.

This is still a very rapidly moving story, so let me attempt to summarize everything that has happened today, so far. If you have not yet read our lead story from yesterday that broke all this news, please see:

WARNING: Big Tech Banks Collapsing! Infection Spreading to Other Sectors

First, the FDIC took over Silicon Valley Bank (SVB) today. And just a reminder, the FDIC only insures accounts up to $250,000.

Only 2.7% of Silicon Valley Bank deposits are less than $250,000.

Meaning, 97.3% aren't FDIC insured.

Ouch. pic.twitter.com/ZCmtOkZr2d

— Genevieve Roch-Decter, CFA (@GRDecter) March 10, 2023

Silicon Valley Bank, one of the tech sector’s favorite lenders, is shutting down.

The California Department of Financial Protection and Innovation announced Friday that it was taking over and closing the distressed bank to protect deposits, naming the Federal Deposit Insurance Corporation as its receiver. The FDIC has formed a separate entity where all insured SVB deposits are being transferred.

The closure marks the biggest bank failure since the 2008 financial crisis and the second-largest on record after Washington Mutual collapsed during that industry-wide meltdown, according to FDIC data.

Like other FDIC-member banks, deposits are insured up to $250,000 per depositor. The agency said it is “working over the weekend” to determine how many SVB deposits are insured.

The shutdown came after a tumultuous morning for the Santa Clara, California-based bank — the 16th largest bank in the country — during which trading of its shares was halted after they fell by double-digits before markets opened. That downslide came on the heels of a more than 60% decline Thursday.

In view of the tumult, Treasury Secretary Janet Yellen told House lawmakers Friday morning, “There are recent developments that concern a few banks that I’m monitoring very carefully, and when banks experience financial loss it is and should be a matter of concern.” (Full article.)

This news has led to a dramatic drop in value in trading for ALL banks, and several of them reportedly suspended trading on the NYSE for a while today. Bank runs have also been reported.

Shades of 1930’s. This is my bank in Wellesley this morning. Boston Private Bank, recently acquired by Silicon Valley Bank. Ruh, roh. pic.twitter.com/MAD46ozShx

— Lawrence Lepard, "fix the money, fix the world" (@LawrenceLepard) March 10, 2023

Two weeks ago, customers were setting banks on fire in Lebanon because they couldn’t get their money out.

Today, police are respond to a disturbance at Silicon Valley Bank’s NYC branch because people can’t get their money out.

Bank runs happen in America. pic.twitter.com/0MllnOBX7c

— Genevieve Roch-Decter, CFA (@GRDecter) March 10, 2023

Venture Capital firms who held accounts at SVB are panicking. The Information reports:

Startups and VCs Scramble to Pay Employees After SVB’s Collapse

The sudden collapse of Silicon Valley Bank sowed panic at hundreds of startups and venture capital firms that banked there and now must seek new ways to pay employees and access funds from their investors and customers.

Founders and VC firms, which also kept billions of dollars worth of assets with SVB, on Friday rushed to figure out whether they could get loans to cover payroll if their funds were still tied up in the bank, which a federal banking regulator took under receivership on Friday.

“The reality is sinking in among founders who are realizing, ‘I have payroll this week and I’m not able to log into my SVB account right now.’ And maybe the money will be there in the future, but they need it right now,” said Billy Libby, CEO of startup debt and equity investor Upper90.

The scramble highlighted Silicon Valley Bank’s deep connections with the tech industry. Besides clients that deposited cash or took out loans from the bank, hundreds of startups and dozens of venture capital firms had received investments from the bank’s venture capital arm.

Its startup portfolio includes crypto compliance firm Chainalysis and credit card startup Jeeves, PitchBook said. Many VC firms, including Andreessen Horowitz and Kleiner Perkins, have also held their money at the bank, according to PitchBook.

One startup founder said they had about $10 million in an SVB checking account when the bank failed. The company’s finance team is now trying to open a new bank account and use the company’s Treasury bills and other securities to pay vendors and employees.

“I am talking to people whose only bank account was at SVB and they are trying to figure out how to make payroll. That’s a true statement. That’s scary for a lot of people,” said Andy Boyd, who used to lead tech investing at Fidelity Investments and now runs Bramalea Partners, a VC firm. (Full article – Subscription required.)

Which Banks are Next?

As this story is now exploding, at least in the corporate media, it is almost comical to read all the varying views and commentary over what has just transpired over the past 3 days with two FDIC-insured banks collapsing.

They range from “Don’t worry, everything is fine, this is nothing like 2008” to others, like myself, who see this as an infection in the financial sector that has been growing for years now.

Wall Street on Parade reported today (note: SVB had not collapsed yet when this was written):

Bank Stocks Plummet as Bank Runs in the U.S. Gain Momentum at Federally-Insured, Non-Traditional Banks

If you keep a diary or news journal, be sure to write down March 9, 2023 as the day that a full-blown bank run began at non-traditional banks in the U.S.

Bank depositors were already nervous after federally-insured Silvergate Bank (ticker SI) announced on Wednesday evening that it was closing and liquidating. Its publicly-traded stock had already lost over 90 percent of its market value over the prior 12 months at that point.

Now, for the second time in less than two weeks, depositors are panicking over the fate of another federally-insured bank. This time it’s Silicon Valley Bank (ticker for holding company is SIVB) which, like Silvergate Bank, had become a go-to bank for a special niche customer. Instead of crypto, its niche was venture capital outfits and private equity firms.

Silicon Valley Bank is not a small bank. According to its regulatory filings, as of December 31 it held $161.4 billion in domestic deposits and $13.9 billion in foreign deposits. (Full article.)

Another bank heavily invested in Big Tech and crypto, Signature Bank, is the one being named most often today as being in trouble, and perhaps being the next one to fail.

Crypto bank Signature slides on Friday amid troubles at Silicon Valley Bank, Silvergate

Signature Bank shares dropped as much as 32% on Friday and were at one point halted amid a sell-off in bank stocks that continued for a second day.

Signature, one of the main banks to the cryptocurrency industry, was last down by 24%.

The initial move followed a big day for its crypto banking peer Silvergate Capital, which announced earlier this week that it would liquidate its bank. Its losses deepened Thursday after shares of SVB Financial, whose Silicon Valley Bank lends to tech startups, announced a plan to raise more than $2 billion in capital to help offset losses on bond sales.

By late Friday morning, the Federal Deposit Insurance Corp had closed Silicon Valley Bank and taken control of its deposits, making it the largest U.S. bank failure since the global financial crisis.

First Republic Bank, PacWest Bancorp, Western Alliance Bancorp were among the other names whose trading was at one point halted for volatility.

Signature has said it has minimal exposure to crypto, but Silicon Valley Bank’s need to recapitalize on the heels of the Silvergate event has linked the two events in some people’s minds.

Valkyrie chief investment officer Steve McClurg said the Signature Bank was already hurting on the back of Silvergate’s losses, which now total almost 50% for the week. Its Friday losses are a spillover effect from the Silicon Valley Bank woes, he added.

Ed Moya, an analyst at Oanda, emphasized Signature is caught in the middle of both narratives.

“Signature Bank is getting hit with a one-two punch as concerns grow that any crypto-related bank could be in danger and as financial instability concerns grow for parts of the banking sector,” he said. “There are only a handful of publicly traded banks that have crypto exposure and lots of traders are rushing to bet against them.” (Full article.)

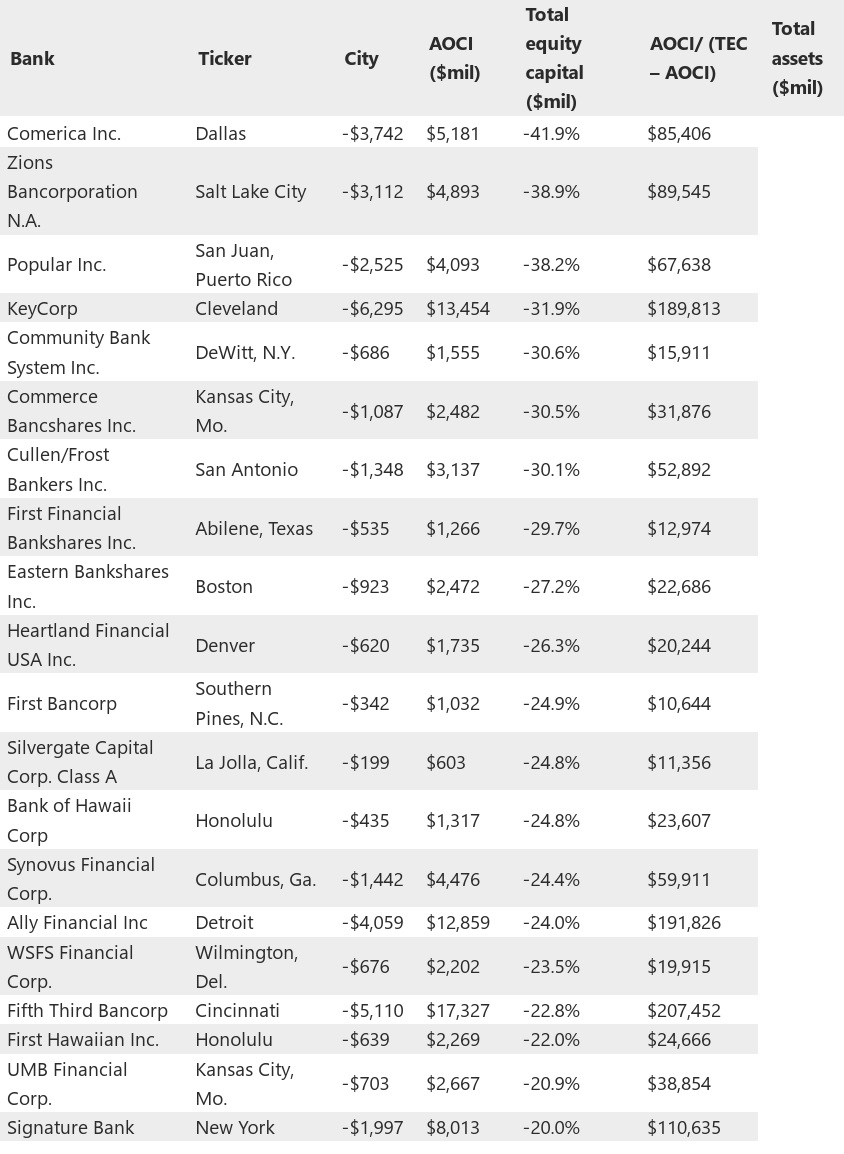

Signature Bank is not the only bank being mentioned, however. Market Watch identified 20 other banks with “huge potential securities losses” like SVB.

20 banks that are sitting on huge potential securities losses—as was SVB

Silicon Valley Bank has failed following a run on deposits, after its parent company’s share price crashed a record 60% on Thursday.

Trading of SVB Financial Group’s stock was halted early Friday, after the shares plunged again in premarket trading. Treasury Secretary Janet Yellen said SVB was one of a few banks she was “monitoring very carefully.” Reaction poured in from several analysts who discussed the bank’s liquidity risk.

California regulators closed Silicon Valley Bank and handed the wreckage over to the Federal Deposit Insurance Administration later on Friday.

Below is the same list of 10 banks we highlighted on Thursday that showed similar red flags to those shown by SVB Financial through the fourth quarter. This time, we will show how much they reported in unrealized losses on securities — an item that played an important role in SVB’s crisis.

Below that is a screen of U.S. banks with at least $10 billion in total assets, showing those that appeared to have the greatest exposure to unrealized securities losses, as a percentage of total capital, as of Dec. 31.

Corrupt Banking Industry Infection Spreading to Other Markets

As I reported yesterday, this banking infection is not limited to just the U.S. financial tech sector. It is an infection that is spreading outside the U.S., and into other sectors, and this infection is just going to get worse.

SVB failure triggers shockwaves across biotech industry

Silicon Valley Bank’s failure has sent shockwaves across the biotech industry and spurred a panic among top venture capital firms, some of whom have confirmed to Fierce Biotech that they have urged their companies to withdraw deposits.

Nearly half of all U.S. venture-backed technology and life science companies bank with SVB—the 16th largest bank in the country—with a total of $342 billion in client funds and $74 billion in total loans.

Vida Ventures Co-Founder and Managing Director Arjun Goyal, M.D., said in an interview with Fierce Biotech that the firm has advised companies to examine their exposure to SVB and transfer that to other banks.

Goyal did not explicitly mention the companies that were advised, but Vida has invested in biotechs such as Volastra Therapeutics, Alterome Therapeutics, Capstan Therapeutics and Aktis Oncology in the past year. (Full article.)

The Information is reporting that the infection has also spread to China.

The panic over the status of Silicon Valley Bank intensified on Friday, as the stock of SVB’s parent fell another 66% in pre-trading hours. Meanwhile, anxieties spread to China overnight, prompting local venture capitalists and entrepreneurs to follow their U.S. counterparts and look for alternative banks for their U.S. dollar holdings.

The fate of SVB is a huge concern in China, the world’s second-largest venture capital market after Silicon Valley, because SVB was among the first financial institutions to start catering to Chinese startups when traditional banks shunned them. The bank established its first Chinese arm nearly two decades ago,

“Silicon Valley Bank has played an instrumental role for us,” said Guanchun Wang, founder of Laiye, a Beijing-based enterprise software startup. “We opened our first bank account with them when the likes of Citi wouldn’t have anything to do with us.” (Full article.)

Is this the Start of Consolidating the Banking Industry to Replace the Monetary System with Central Bank Digital Currencies?

Corporate executives at Silicon Valley Bank are being criticized today because they allegedly sold over $4.4 million in stocks two weeks ago, suggesting that they knew ahead of time what was coming and that their bank was going to fail.

Silicon Valley Bank CEO, CFO and CMO sold +$4.4MM in stock over the last 2 weeks.

But they didn’t know anything right? pic.twitter.com/mipeaRKgn6

— Genevieve Roch-Decter, CFA (@GRDecter) March 10, 2023

This begs the question as to whether or not we are seeing the beginning of a planned take down of the financial system in order to replace the monetary system with Central Bank Digital Currencies (CBDCs).

As I have previously reported, there is strong opposition to the roll-out of CBDCs, especially among smaller banks and credit unions. See:

Local Banks and Credit Unions Beginning to Realize that Implementing Central Bank Digital Currencies will Drive Them Out of Business

This liquidity crisis is due mainly to the Fed’s policies of driving up interest rates, and if more bank runs are going to take place, which seems most likely at this point, which banks are going to be the ones that suffer the most?

Smaller, local regional banks are the ones that could easily be driven out of business, or swallowed up by the larger banks.

One of the best analyses I read today about what has been happening for the past few days was an article published this morning on ZeroHedge News.

300 Billion Reasons Why SVB Contagion Is Spreading To The Broader Banking System

And while this article does not address the issue of rolling out CBDCs, it explains very well why the smaller, local regional banks are the ones most in trouble right now.

Here is a quote:

Which boils down to the following: if depositor confidence in the regional/small bank sector is now shot – and after both Silvergate and SIVB it very well may be – we will see a small (to medium if not larger) deposit run among the regionals which could prove devastating for these reserve-constrained banks which will need to scramble to raise capital a la SIVB in what eventually transforms into a death spiral for the sector, especially if depositors take one look at what is going on with regional bank prices – which have been in freefall in the past two days – and extrapolate what may come next – there’s a reason why banking is the ultimate confidence game.

There is one way to short-circuit this process and it, of course, involves the Fed which would need to step in the way it did in September 2019 when it was the big banks – namely JPMorgan – that were reserve-constrained, and forced the Fed to launch “Not QE” (but only after the US repo market suffered some historic rollercoaster moves). Ironically, even if the Fed does somehow whisper words of reassurance, the question is why would depositors park their money at “suddenly” risky banks when they can just buy a 6M T-Bill and get the same return with zero risk.

Yes, the Fed may have no choice but to cut rates if it wishes to save the (regional) banking system. But then again, the Fed is still stuck fighting runaway inflation, which means that Powell is now trapped, and as we tweeted previously, Powell is now trapped: More hikes: regional banks collapse; Less hikes: inflation target must be raised.

So will Powell let America’s small, regional banks risk failure as a result of his rate hikes (an outcome the likes of JPMorgan would find quite beneficial as it will make them even bigger), or will the Fed chair step in the way he did in 2019 even if it means gambling with runaway inflation? The right answer to that question could make some traders extremely rich.

The entire article is well worth reading at ZeroHedge News.

This article was written by Human Superior Intelligence (HSI)

See Also:

Understand the Times We are Currently Living Through

New FREE eBook! Restoring the Foundation of New Testament Faith in Jesus Christ – by Brian Shilhavy

Who are God’s “Chosen People”?

KABBALAH: The Anti-Christ Religion of Satan that Controls the World Today

Christian Teaching on Sex and Marriage vs. The Actual Biblical Teaching

Exposing the Christian Zionism Cult

The Bewitching of America with the Evil Eye and the Mark of the Beast

Jesus Christ’s Opposition to the Jewish State: Lessons for Today

Identifying the Luciferian Globalists Implementing the New World Order – Who are the “Jews”?

The Brain Myth: Your Intellect and Thoughts Originate in Your Heart, Not Your Brain

What is the Condition of Your Heart? The Superiority of the Human Heart over the Human Brain

The Seal and Mark of God is Far More Important than the “Mark of the Beast” – Are You Prepared for What’s Coming?

The Satanic Roots to Modern Medicine – The Image of the Beast?

Medicine: Idolatry in the Twenty First Century – 10-Year-Old Article More Relevant Today than the Day it was Written

Having problems receiving our emails? See:

How to Beat Internet Censorship and Create Your Own Newsfeed

We Are Now on Telegram. Video channels at Bitchute, and Odysee.

If our website is seized and shut down, find us on Telegram, as well as Bitchute and Odysee for further instructions about where to find us.

If you use the TOR Onion browser, here are the links and corresponding URLs to use in the TOR browser to find us on the Dark Web: Health Impact News, Vaccine Impact, Medical Kidnap, Created4Health, CoconutOil.com.

Join the Discussion